Wednesday, December 20, 2006

Just a random thought on Interest rates, economy, international concerns, etc...

In the rest of the country, the economy is not as strong as it is in Utah. The real estate boom that the rest of the country enjoyed in the last two years pretty much sidestepped Utah altogether. In other areas, it was fueled by a large school of nationally motivated real estate investors, primarily from California, who were only looking at one factor in making purchase decisions: real property value appreciation. These were "paper-rich" people whose only increase in net-worth was through a massive increase in the value of their own real estate. Nobody was getting paid more at their jobs, nobody was winning the lottery, etc. When this happens, there is no local support for that increase in value - the local wages haven't changed to support the new values, so the locals aren't the ones buying homes, they're essentially locked out.

This, among a couple of other factors, produces a classic real estate bubble. By definition, the bubble is not self-sustainable, and is therefore susceptible to bursting - where the bottom drops out just as fast as it grew in the first place - which means the investors move to other places, like flies.

When investors become successful in areas, lender follow suit, and the whole industry balloons up, supporting this increased activity. If interest rates are a problem, in relation to the Federal Reserve rates, they will simply come up with programs that will allow these investors to be successful regardless. Note here as examples, Option Arm Loans, 100% financing, 2- and 3- year Arms, "Alt-A" lending, etc. Lenders will always to find ways to produce programs that make it possible to acquire the business of these investors. Lenders are in the business of selling money, that's what they do.

So, with all that being said, our little local state-wide economy, with the possible exception of Washington county (the fourth-fastest growing county in the nation, at last count), we have just chugged along. Sure, there are investors here from out-of-state buying homes they never intend to live in, or even hold for more than a year, but on the whole, these people are balanced out with the other members of our community.

Our unemployment rate is among the lowest in the nation, and employers report having difficulty attracting and keeping talented workers. It's so low, it basically is at the point where those who want to work, are doing exactly that. This does things to the housing market as well. When everybody who can, or wants to, is working, they are confident en masse. They are willing to buy homes, move up, or make improvements. This balances the investor pool as well, and makes the entire picture more stable.

So on to the "perfect storm" theory. When an economy is burgeoning, as ours is, and rates are fairly low and stable (5.625% 30 year fixed in Utah right now), and there is relatively low investor activity (because they have been taken out of the game from losses in other unstable markets - like Vegas, Phoenix, etc,), balance comes to the whole, and stability ensues.

Couple that concept with the following thoughts:

1. The economic bounty will likely last well into and through the next 24 months, or longer.

2. While we are on an interest rate upswing, that will only last for about that much longer as well, maybe 36 months or so.

3. Utah is not, and will not be, bothered by the mass of national real estate investors, because they are pretty much out of the game at this point.

This gives me the thought that we may well be insulating ourselves from that rate upswing with a strong local economy, allowing Utah to move through the next 24-36 months without much of a real estate downturn, either in valuation or in market inventory.

I think this is good for us, into the foreseeable future. Our job growth economy will carry Utah through to the next interest-rate downturn, and then we'll have another refi boom, people will be happier with borrowing money, lenders will be happier to sell it, and rates will be driven even further down, default rates will lower, international monetary investors will like the dollar better, because the nation's GDP will be better, and all will be well in happyville.

So, contrast this happy story to this one, in California, where values went through the roof, unsupported by the local economy: here

Monday, December 11, 2006

At some point, the borrower HAS to be accountable

Every day, Will Hertzberg owns a little less of his three-bedroom house in Corona. Like hundreds of thousands of other homeowners around the state, Hertzberg has a mortgage that lets him choose how much he pays each month. Like many of them, he always chooses to pay as little as possible.

His debt is swelling, and his mortgage company controls his fate. 'I am rather screwed,' he said.

Hertzberg could sell now, but his lender would charge him an $11,034 prepayment penalty, money he doesn't have. Yet if he stays, the housing market may tank, vaporizing what little equity he has left. 'I made choices, and they happened to be the wrong choices,' said Hertzberg.

One of his options is to pay $2,513 a month. That would cover the principal and interest as if it were a traditional 30-year loan. A second possibility is to pay $2,279, which would cover only the interest. But each month he always takes the cheapest option: paying $1,106 and promising to make up the shortfall later.

In 2003, only about 8 of every 1,000 people buying a home or refinancing a mortgage in California got a pay option loan, according to First American LoanPerformance. Last year, 1 in 5 loan applicants got one.

In the first eight months of 2006, even as the real estate market began to weaken amid fears of a downturn, the appeal increased again. Nearly 1 in 3 California loan applicants are now choosing them. The state boasts about 580,000 active pay option mortgages, about half the U.S. total.

Hertzberg bought his house 11 years ago for $129,995. With fresh paint and a few repairs, Hertzberg could probably sell his place for $275,000 more than he paid. He would see little of that, however, because he's already seen so much. Over the years he has taken out $190,000 in cash through refinancings.

Hertzberg's home equity paid off his credit cards, financed trips around the world, bought a $32,000 Toyota Avalon and enabled some lousy investments. He bought dot-com stocks and lost money. To recoup those losses, he bought commodities, and lost money faster.

'Free money always has the unfortunate effect of making people go overboard,' said Hertzberg, whose living room is strewn with financial publications including American Cash Flow Journal and Donald Trump's 'How to Get Rich.' 'You'd be surprised how fast $190,000 can go.'

Last fall, he went to a mortgage broker and refinanced again to make his payments easier to bear. He thought he would have a five-year window before the principal started coming due.

But the day of reckoning is arriving early. By paying the minimum, Hertzberg has increased the size of his loan in a little over a year from $320,000 to $332,616. His lender, Countrywide Financial Corp., recently sent him a letter warning that when his loan hits 115% of its original size he'll run out of credit with the company.

That will happen in about two years if he continues to take the smallest payment option. Then his minimum payment will automatically go up 150%, to $2,848 a month. 'If I could afford that,' he said, 'I wouldn't have needed this loan in the first place.'

It's a sorry situation, and Hertzberg is generous in assigning responsibility for it. To start with, he blames his mortgage broker, who didn't advise him how risky these loans were.

Few brokers do, U.S. Comptroller of the Currency John Dugan says. In an October speech, Dugan said the marketing materials for payment option loans often 'emphasized the low initial payments but glossed over the likelihood of much higher payments later.'

Although Dugan and other regulators are taking steps to address both problems, Hertzberg said they never should have allowed these loans to become so prevalent in the first place. 'The government wanted to keep the housing party going,' he said.

Yet who didn't want that? Hertzberg admits he was a willing co-conspirator. 'I got spoiled and complacent and was not prepared when the bottom fell out,' he said.

Several times a week, he gets a refinancing offer in the mail. Hertzberg always looks at these fliers, hopeful in spite of himself. 'I'm waiting for a 100-year loan,' he said. 'My heirs can worry about paying it off.'

This unfortunate borrower is right to blame his mortgage broker, but I would wager that, if pressed about it, the great preponderance of borrowers who find themselves in this situation knew what the pitfalls were with this particular loan type. (If you want more detailed info, look for it here.)

MANY homeowners over the last 3 or so years have ended up purchasing a home that they had no business even looking at. Whether it was simply that the price tag was too high, their credit too bad, their income situations too unstable... whatever. Having been in this business for a while, there are always people who are buying too much house. I can tell who they are every time they walk into the office. They have no money to put down, and most of the time (95%) have no money to even pay for closing costs, and have negotiated these with the seller.

Who is to blame for this? Some will say that the lender is to blame - while others will say that it is the buyer who shoulders the blame. In reality, and in a perfect world, the buyer is the one who is to blame here. Remember that in that "perfect world" the mortgage broker has educated the borrower on all aspects of every type of loan program under consideration, and the buyer has enough information upon which to base an educated decision. You would think that this fact alone would alleviate this entire problem, but you are wrong. By and large, with visions of sugar-plums dancing in their heads, a buyer reaches a point where it makes no matter whatsoever what the risks are, "all we want is to get into this house and have a $1200 payment, because that is what we can afford. You have a way to get me into this $500,000 house for that payment, and that's what I want."

A mortgage broker who does not educate his clients about every type of loan under consideration does a disservice to his client.

There has been lots of talk over the last year about how the government regulatory agencies need to crack down on this type of loan, and how those loans need to have more guidance, perhaps more disclosures to be signed by the borrower, etc. But at some point, the accountability needs to rest solely and squarely on the shoulders of the person who signed the note.

People's eyes get big, and we get this glazed thing that comes over us when we see a dream right before us, sitting there, calling our name, the song of a sexy siren right there in front of us. It happens all the time, with cars, vacations, jewelry, etc. It's bad when it happens when we're talking about a home, because it is a huge-ticket item, and it carries with it the possibility of catastrophic financial ruin. The glutinous consumption that is carried by a society's economic wealth is a problem.

So, dear borrower, if you're looking at a house for which you can only afford to make a "minimum payment", not even covering the total of the interest that is due each month, you deserve what you get. And what you will get is foreclosed upon.

Wednesday, November 29, 2006

Hand Cramps

When I sit down to go through paperwork with new clients, they invariably remark how much of a drag it is to have to sign so much stuff. You typically have to sign your name to 50ish pieces of paper before the process is done.

When I sit down to go through paperwork with new clients, they invariably remark how much of a drag it is to have to sign so much stuff. You typically have to sign your name to 50ish pieces of paper before the process is done.But remember, each time you sign your name, you're doing so in response to some law being broken in the past, or some law suit that was launched in the past.

It's like that box of soap that says "Do not take internally".

You think to yourself, "who would do THAT??"

But they put it there because somebody DID eat it, and the manufacturer now seeks to protect itself from future soap-eaters.

So, when you sign your name during a mortgage process, it's because somebody is protecting you and making sure you have seen everything you need to see about the process.

Are New Home Builders Skewing the Numbers?

Therefore, a builder can offer such things at great vacations, or new cars, in order to entice a buyer into signing a contract to buy. These incentives allow the builder to report a "full contract price sale" indicating a strength in the numbers that is not reflecting the cost of the incentives offered. This makes the builder appear to have sold the home at a healthy full price.

Which makes the builder appear healthier than they might be in reality. It also skews the housing numbers as reported in the media.

For example - in today's news:

From Wall Street and Washington: “Sales of new homes fell 3.2% in October to a seasonally adjusted annual rate of 1.004 million, the Commerce Department estimated Wednesday. New-home sales are now down 25.4% in the past year. Measured out over the first 10 months of 2006 compared with the same period in 2005, sales are down 17.9%.”

“Median sales prices were up 2% in the past 12 months to $248,500. Home builders have piled on incentives, including offering free vacations and new cars, to sell homes and work off inventories. Such incentives are not subtracted from the sales price reported to the government.”

Therefore, the housing numbers may not be something that should carry as much specific weight in nationally reported economic indicators.

What is the harm here then? It's this: When a home is built and sold in a subdivision by a builder, they finish and move on. They leave behind a group of homeowners who drive new Jeeps or even a new Mercedes (or some other DRASTICALLY depreciating asset - albeit one for which most Americans are HORNY), but whose homes won't appraise for what they bought them for.

Appraisers must take into account all sales incentives that were used in the original sale of a home. For example, if a home was contracted for $400,000, it is reported on the top line of an appraisal form. Any incentives or concessions used are then mentioned on the next line down and those incentives are SUBTRACTED from the home's current value, or its value as compared to the other homes in the neighborhood. A home that was purchased for (and has a mortgage for) $400,000, but had a $30,000 incentive on it, is now appraising for $370,000, all other things being equal.

This leaves a group of home owners who are most likely upside down in their homes. 99% of them didn't put any money down either, making the situation even more dire for them.

I have heard reports from places like Las Vegas, where there are vast subdivisions that have a 70% vacancy rate. Only three of 10 homes actually have people living in them.

Try getting a good appraised value in a neighborhood like that.

But the builder is apparently more healthy as a result of this wrangling, and they effectively shore up their share prices as a result, thus achieving their overall goals as a company. Lest you think a builder actually cares about you, the buyer.

You are simply a commodity.

Wednesday, October 11, 2006

Confessions of a Mortgage "Professional"

An article introducing a book (but not reviewing it)... By Douglas MacMillan

Read this with the following glasses on:

1. Somebody is trying to sell a book here

2. Media likes to trade on fear, scandal, and general salaciousness

The article is followed by a group of the most recent reader comments about the article. My comments will follow at the bottom.

The Durham (N.C.)-based nonprofit Center for Responsible Lending estimated in July, 2001, that predatory mortgage lending is currently costing Americans more than $9.1 billion each year.

Lenders will argue that each one of these dollars represents a legitimate fee stipulated by a legitimate contract, that they are only viewed as predatory by borrowers who overlooked the fine print in their mortgage.

But ask Ted Janusz, who spent an interim period of his career learning the ins and outs of mortgage brokering as a loan officer in Columbus, Ohio, and he'll admit that what is really going on here is a game of subterfuge being played at the expense of borrowers with low credit ratings.

CONFESSION TIME. The strategy of lenders, he learned, is to maintain an uneven playing field with their clients. "The average person only gets a mortgage every seven years. How can you become good at something you do every seven years, especially if you're dealing with somebody who knows all the ins and outs and is doing this several times a day?" he recently told BusinessWeek.com.

After a year of putting up with what he felt was the industry's lack of integrity, Janusz left the business for good. Still, he felt he was privy to information that the public rarely gets to see. He vented his frustrations—and spilled his guts—in the 2005 book Kickback: Confessions of a Mortgage Salesman (Insight).

The book details the sophisticated traps lenders set for clients they see as suckers. "If somebody came in wearing cowboy boots and ripped-up jeans, those are the people you took to the cleaners on fees. That was the unwritten rule—we were looking for people we'd see as having less-than-perfect credit."

TUNNEL VISION. Lenders who found a mark would make sure the money was ending up in their pockets mainly through back-end yield spreads, or the so-called Service Release Premium. For example, they would tell the borrowers that they could have a 9% interest rate, but when the paperwork cleared, their low credit rating would force them into an 11% rate—often without the borrower even knowing it. The resulting dividends, thousands of dollars in each case, fell into the lenders' laps.

In his book, Janusz also highlights an array of common traps lenders use all the time, such as allowing a borrower to see an attractive interest rate offer and letting him think that's the only important consideration in a mortgage negotiation. "You hear companies offer fabulous rates, but what are they paying in closing costs to get them?" Janusz says. "It would be like comparison shopping for cars only looking at the headlights."

Nickname: TD Hawk

Review: Full disclosure, I'm a Certified Mortgage Planner. I'm wondering if BusinessWeek is running out of story ideas? A few weeks ago, a cover story about "How toxic is your mortgage?", then this biased piece and, for over a year, there's been a video "Un-ARM Yourself." In regard the latter, the cost of mortgage money is falling--the lowest it's been since March--and will continue to do so into 2007. Why? The Fed is hell bent on slowing our economy and the cost of money falls when that happens. So folks following all this sage media advice will be "buying high" if they run out and lock a fixed rate. But the bottom line folks, do business with someone you know and trust based on referrals from those you know and trust. There are no deals in financial services unless you're related to the provider. Read everything and know the cost of money is what it is for everyone in the same credit profile shoes. And don't plan your finances based on anything in the media or you'll "buy high" yet again.

Date reviewed: Oct 11, 2006 11:31 AM

Nickname: Bill and Art

Review: I read comments for an hour -skipped some, read many. I was more interested in what the real estate industry people said than the consumers - I've heard many a sad tale from borrowers that ranged from complete truth to a lack of understanding of risk (it is important to pay your bills occasionally) to total I-really-thought-my-rate-was-1 percent-forever lies. While I am not a proponent of the ugly slogan "buyers are liars," I find the exposure to the experience of two or three mortgages less enlightening than the hundreds the average, seasoned (not one year) mortgage person embraces.

Date reviewed: Oct 11, 2006 2:39 AM

Nickname: K-Dubb

Review: There are charlatans in every industry, work sector, business, for- and not-for-profit, etc. I've been a loan originator for five-plus years and I'm astounded how many times I've conducted Mortgage 101 lessons for clients - homeowners mindful of only their rate and payment. Many are unaware that even when their quoted rate and final (funding) rate are the same, their qualifying rate may have been lower. The difference went into the lender's and/or loan officer's pocket. In purchases - not just "sales" - everything is negotiable. You have to know your options, what you qualify for (not just "your rate"), the total expenses (not just "closing costs"), and to review or have assistance reviewing the loan papers before you sign. Failure to conduct due diligence is plain ignorance - the government, which many want to reduce in size and scope, can't be your financial babysitter.

Date reviewed: Oct 11, 2006 2:14 AM

Nickname: Geezer

Review: It's hype, hype, hype designed to frighten the public, sell commercials, newspapers, and expose books. Not all lenders are bad (most aren't) and not all loan officers are bad (some are). And not all police, firemen, lawyers, politicians, in-laws, athletes and movie stars are good either. If you fall for the hype, the ads, the news, you'll get burned.

Date reviewed: Oct 11, 2006 1:59 AM

Nickname: Art

Review: People need to be responsible for their own behavior. All of Madison Avenue is trying to get your money. Lenders are no better nor any worse. We eat fast food we know is killing us. We smoke cigarettes that destroy our health then praise the tobacco companies for offering rehab programs. Lenders just got in it a little later: 1 percent loans?! Zero closing costs?! 50-year mortgages?! Come on. Grow up. It's hype. Live on less than you earn - save your money - and no one can scam you. If you don't gamble you won't meet a leg-breaker one night. Pay your bills and you won't deal with the lending liars. Daddy always said, "Don't believe everything you hear." That's pretty good advice.

Date reviewed: Oct 11, 2006 1:51 AM

Nickname: Ranchexit

Review: In all fairness here, Mr. Janusz is trying to sell a book. The "expose" is his tickler and fits in well with our overhyped media-driven world. While there is truth in what he says, such shabby and deceptive treatment of consumers is limited to a few greedy lenders (I could guess his employer's name fairly easily) and opportunists. There are to be found both conscientious lenders and the louts. Sadly, the self-serving mentality of the latter is found in other industries: Enron execs bilked life savings out of thousands and eyebrows were raised, but little justice meted out. Yet if we pay an extra point in closing costs (even if our credit stinks)-we get torqued because it's us. I am opposed to usury. I am also opposed to people overspending, living on (declining) credit, and our instant gratification mentalities. Let's all teach our kids about credit, starting at home and continuing in school. It's hard to get scammed when you have perfect credit and can get your loan anywhere.

Date reviewed: Oct 11, 2006 1:37 AM

Nickname: yogamom

Review: Are you kidding here? The purchase of real estate is by far the most important financial decision most people will make. Those who serve in the real estate profession as agents mortgage brokers and appraisers sound unscrupulous. Someone must stand up to these individuals. Be a smart consumer and walk away from any person participating in these practices. Money is money whether the person has less than perfect credit or not they still deserve the best deal and the best service. Do not call yourself a professional if you behave otherwise toward consumers.

Date reviewed: Oct 11, 2006 12:01 AM

Nickname: experience counts

Review: Seeing the comment from "Seen it all," dated Oct. 2, I have this to say: For someone who has supposedly been in the "industry" for 20 years, you must be either a) an idiot, or b) you buried your head in the sand a long time ago. Do you still use a typewriter to process applications?

Date reviewed: Oct 9, 2006 5:25 PM

Nickname: Matt

Review: My suggestions to anyone who is going for a home loan and it's either your first time or you haven't done it enough to be confident about it, talk to someone you know who has either moved a lot or is a real estate investor. I have done both. I'm to the point where I've applied for a home loan at least once per year for the last seven years (in some years, it was actually twice). I know the mortgage loan process better than some of the mortgage processors I've dealt with now. Overall, mortgage loan folks are not that experienced, and it's a fairly high turnover business. You'll see that the more experienced you become at it, you'll wind up doing the thinking for your mortgage loan processer. That's both good and bad, but I think you'll agree, you're better off when you know more than them! In short, talk to someone who's been through the loan process a lot. It will pay big dividends when you go for your own loan!

Date reviewed: Oct 8, 2006 2:43 PM

Nickname: helpingmyparents

Review: My parents are senior citizens and on a fixed income. What they both bring in together every month is probably what some make on one paycheck. They were doing fine with their mortgage until they went to refinance. Normally I'm always there overseeing their financial matters. This time my father did it alone trusting what he was told. In the end, his mortgage payment went up $200 a month with a promise that after two years he could refinance to bring it back down. Completely impossible because the gentleman assisting him combined two loans that he co-signed on for two of his children a total of $15,000 bringing his loan amount to $75,000. My question is how on earth did this gentleman refinance my dad for a mortgage for this amount with such little income? I'm thinking it's a case of predatory lending, but not sure. Dad's kids continued making their monthly payments to him to offset the difference in his mortgage payment but they are now being paid off. Anything I can do to help him?

Date reviewed: Oct 8, 2006 1:09 PM

Here's the bottom line: there are people out there who don't take responsibility to learn what they need to know about this, the most important of decisions. They may also not even know what questions to ask. So many homebuyers these days have hired the moving company, moved out of the old place, are living in a trailer somewhere, have no money whatsoever, want 100% financing, have pawned the dog to buy a truck, and are waiting on the driveway of the new hoouse before they have closed the loan. Are these people REALLY concerned to go over each line item and understand the real cost of money. The answer is no. They are so horny to get the new place that at some point in the past, they stopped caring what it was going to cost them, either in the long run or the short one.

The lending industry is also full of people who will take advantage of anyone available. There are also those who understand the concept of Karma, repsect, and being able to sleep well at night. Some don't care.

A while back I discussed how mortgage lending works: as far as a broker is concerned, there are two main income producers: Origination points, and Yield Spread Premiums. Both are income - the first is an "up-front" cost, paid through a line item on the settlement statement. The second is a fee paid to the broker by the lender. This fee is based on the "spread" between the "base/par rate" and the rate that the loan is actually closed with. This total income amount is used to not only pay the loan officer, but is also used to pay the other office staff, brokerage fees, utilities, phones, rent, paper, long distance, etc. The loan officer will typically see a percentage of this total amount as actual income to him/her.

On the settlement statement, the second amount, yield spread premium, is noted but not included in the "cost" of the loan, or the cost of money, if you will. It is noted outside of the standard tabulation of costs. It is easy to miss, and one easily would think that since it is not in the tabulation of costs accrued, that it really isn't a cost at all. But this is wrong. If there is a yield spread premium noted on the sheet (anywhere) it means that you are paying more in RATE on your loan than you otherwise might, had you been educated to this, and given the choice about it.

I have also noted that I seek to educate my borrowers, both well-heeled and not, to the ways I make my income. I tell EVERYONE that my services cost ALL BORROWERS, regardless of credit or life situation, about 3% of the purchase price of the home. This is common, and it is what I think my services are worth. You don't work for free, and neither do I. My job is difficult, arduous, and incredibly stressful and time-consuming. I will educate you as to what you qualify for, what is reasonable for you, and what I think you should do. I also give you the choice as to how you plan to pay that 3%. I explain that you can get a slightly lower rate if you choose to pay your fees to me in origination rather than YSP. This is easy for almost ANYONE to grasp, and I rarely have a problem with people on this issue. They value my service, and, most of the time, refer other trusted friends and family to me as well. They obviously like what I did for them. Almost everyone chooses to split the difference and pay some origination and some YSP.

You should note as well that the relationship between your rate and YSP is NOT a 1:1 ratio. That is to say that it will not cost you 1% in your rate in order to pay me 1% in YSP. Usually the ratio is 2:1 or 3:1 - that is to say that it costs a half a point in rate to pay me 1 point in YSP. Some lenders are even more generous and offer a .365 (3/8ths) rate bump for one point in YSP. I tell people this, they do the math, and make the choice.

Now all this is not to say that there isn't room for improvement in the industry, either through some sort of ethics standards, or industry oversight... for example, NO end lenders out there require the broker to disclose YSP in dollars and cents on the good faith estimate provided to the borrower at the time of initial application. I think this should be changed. Lenders now only require that a generic notation be made that the broker "May receive between 1-3% in YSP, not paid from the proceeds of the loan." This SOUNDS like it isn't a cost, but it is.

So, after all this, ask yourself one question: If you want to quibble with an upright, ethical mortgage broker about paying 3% in fees for securing an appropriate mortgage for you, what value are you getting from paying a real estate agent? Think about that. They are making a MINIMUM of 3%, sometimes up to 6% on the transaction. Your ire is missplaced, friend.

Tuesday, October 10, 2006

New Mortgage Regulations said to accelerate home price deflation

When you apply for a mortgage, your ability to pay is evaluated on a "Qualifying Rate". In the past few years, this qualifying rate has been the TEASER RATE, instead of the actual APR percentage rate. By this alone, it is obvious to see the lending frenzy that has led many people to the place we are now.

If you wanted to buy that $500,000 home, but only had the real financial resources to be able to cough up $800 per month, the lender WOULD STILL LEND YOU THE MONEY FOR THAT HOUSE, regardless of the obvious fact that there was NO WAY ON EARTH that you were going to be able to make the "real" payments six months from now.

Which leads us to the next question: Who really is to blame for all these people who are in trouble with their loans? Is it the lender who lends, or the borrower who borrows?

I often have trouble with that question, because I am a broker. I am the middle man - I connect the lender to the borrower. I do my very best to educate, inform, and disclose all the pertinent information to my clients. Sometimes there are those who are simply utterly insistent in the face of the glaring facts. Some we turn away, and about others we say, "we just met with a foreclosure waiting to happen."

Without ado, the article:

From the LA Times - (Registration Required). Federal regulators are casting a disapproving eye on mortgages that give borrowers low introductory rates but let them pile up more debt over the long run, a loan feature favored by hundreds of thousands of Californians.

Starting this month, federally chartered lenders are being discouraged from qualifying buyers based on the low starter rates, when only the interest or a portion of the interest is due. Instead, they are being urged to evaluate the borrower's ability to pay for the loan at the full rate.

Regulators are trying "to add some discipline to the lending process," said Richard Wohl, president of Pasadena-based Indymac Bank. "Whenever you do that, you're going to have some [borrowers] that won"t have the product available to them."

The regulators say they will "carefully scrutinize" lenders to see whether they are following the new rules. Those who fail to do so, the guidance summary warns, "will be asked to take remedial action."

The guidance applies only to federally chartered lenders, including Indymac, Countrywide Financial Corp., Washington Mutual Inc. and other behemoths. State-chartered banks, which are smaller but more numerous than federal banks, are not affected.

Indymac's option ARM business is shrinking anyway, Wohl said, as interest rates fall and customers move to the certainty of fixed-rate loans. Even so, interest-only and option ARM loans accounted for more than half of first-time mortgages and refinancings in the state in July, according to First American LoanPerformance.

Kathy Dick, deputy U.S. comptroller for credit and market risk, said interest-only loans and option ARMs originally were for a minority of savvy, well-off people whose income was variable, the self-employed and those who worked on commission or were paid intermittently.

"Now they're used to getting someone into a home without a real analysis of their ability to pay," Dick said. "Lenders are qualifying people for homes they can't afford. We felt that wasn't consistent with prudent lending principles."

"Just as the loosening of credit standards made the housing bubble go higher and last longer, the tightening of standards is going to make it deflate further and faster," said Michael Calhoun, president of the Center for Responsible Lending. As borrowers find they qualify only for smaller loans, Calhoun predicted, sellers will have to cut their prices.

"There's some pain coming," he said, noting that California "is at ground zero on this."

"There will be fewer leveraged loans of this kind, and it will depress some home prices," said Allen Fishbein, director of housing and credit policy for the Consumer Federation of America.

Thursday, October 05, 2006

Kiplinger's: Getting it Mostly Wrong on Down Payment

Let's start by saying Kiplinger's Personal Finance is a solid personal finance publication which, most of the time, gives sound advice.

That said, I wanted to take just a moment to flush out the silly mythology and flawed logic behind their recent "case study" advising aspiring homeowners to not buy a house with no money down. The media generally gets the "risks" of not putting money down precisely backwards - characterizing low or no money down loans as risky to the homeowner in the extreme. I disagree. Here are Kiplinger's reasons not to buy a home with no money down taken (apart) one at a time:

1. With a zero-down-payment loan, "you aren't building any equity in the early years," says [CPA and Financial Advisor Michael Eisenberg.] "If you're forced to sell, you could lose money."

Newsflash: Regardless of whether or not you have equity if you are forced to sell, you could lose money. One has nothing to do with the other. Money lost is money lost. This is also reason 278 not to follow someone's advice just because they have a title like CPA or financial adviser. Equity growth has nothing to do with downpayment - your equity doesn't GROW faster with the "fertilizer" of purchased equity at the beginning. Property appreciation is BY FAR the biggest contributor to an equity position. And the ONLY other contributor to "increased equity" is the repayment of principle borrowed. Downpayment money is equity "purchased". You already HAD the money, now you've tied it up. However, understand that down payment money IS useful for securing a better mortgage rate. But it has NOTHING to do with equity.

2. Equity in your home also gives you a source of cash in an emergency.

Unless of course that emergency happens to be a job loss, or illness that forces you to stop working. Then the only way to get at your equity will be to sell the home. Equity is not very liquid, and tends to be very hard to get when you need it most.

3. With less than 20% equity in a home, you'll generally have to buy private mortgage insurance, which costs up to 1% of the loan amount.

Or, you can use a second mortgage (with tax deductible interest) to avoid mortgage insurance altogether. As well, MANY lenders today offer single loans at higher than 80% loan-to-value, WITHOUT mortgage insurance.

4. And the bigger the down payment, the lower your monthly payments.

Really - could Kiplingers logic BE more wrong?

This is true, but a little misleading. With rates at current levels, each $1,000 put down will save a homeowner between $6.00 - $7.00 per month. That means a $10,000 down payment, saves 60 dollars per month. It takes a very large down payment to impact affordability in a meaningful way.

I am not sure how much more clear I can be here: A zero down payment loan (provided of course you can afford the payments in the first place) is NOT "risky" for the borrower/owner. The only party taking on more risk is the bank. So tell me, would you rather risk your own money in a deflating housing market, or the bank's?

Utah RE Market Data

Here are some recent figures regarding Utah's Real Estate marketplace. the chart below shows price range, number of homes on the market, and average days on the market.

| Listings: 1 | Residential Market Summary | Date: 09/12/2006 05:30 PM |

State:UT Status:1

| Active Listings | ||||

| $0 | - | $9,999 | 25 | 114 |

| $10,000 | - | $19,999 | 38 | 120 |

| $20,000 | - | $29,999 | 47 | 73 |

| $30,000 | - | $39,999 | 49 | 94 |

| $40,000 | - | $49,999 | 60 | 73 |

| $50,000 | - | $59,999 | 72 | 94 |

| $60,000 | - | $69,999 | 100 | 90 |

| $70,000 | - | $79,999 | 124 | 83 |

| $80,000 | - | $89,999 | 156 | 87 |

| $90,000 | - | $99,999 | 161 | 65 |

| $100,000 | - | $119,999 | 332 | 59 |

| $120,000 | - | $139,999 | 493 | 51 |

| $140,000 | - | $159,999 | 481 | 46 |

| $160,000 | - | $179,999 | 578 | 45 |

| $180,000 | - | $199,999 | 622 | 49 |

| $200,000 | - | $249,999 | 1,338 | 51 |

| $250,000 | - | $299,999 | 1,279 | 56 |

| $300,000 | - | $349,999 | 1,028 | 55 |

| $350,000 | - | $399,999 | 824 | 58 |

| $400,000 | - | $449,999 | 570 | 58 |

| $450,000 | - | $499,999 | 537 | 58 |

| $500,000 | - | $599,999 | 663 | 63 |

| $600,000 | - | $699,999 | 449 | 64 |

| $700,000 | - | $799,999 | 287 | 65 |

| $800,000 | - | $899,999 | 186 | 69 |

| $900,000 | - | $999,999 | 125 | 66 |

| $1,000,000 | - | $1,249,999 | 123 | 85 |

| $1,250,000 | - | $1,499,999 | 112 | 79 |

| $1,500,000 | - | $1,749,999 | 64 | 119 |

| $1,750,000 | - | $1,999,999 | 74 | 121 |

| $2,000,000 | - | $2,499,999 | 49 | 131 |

| $2,500,000 | - | $2,999,999 | 48 | 116 |

| $3,000,000 | - | $3,999,999 | 36 | 129 |

| $4,000,000 | - | $4,999,999 | 14 | 113 |

| $5,000,000 | - | and over | 21 | 147 |

The average listed home along the Wasatch Front (including all price ranges, HUD homes, short sales, and bank-owned homes) has been on the market for 60 days.

Wednesday, October 04, 2006

What is an Exotic Hybrid Mortgage?

Lots of talk (even at the FED/Bernanke level) about "exotic hybrid mortgages" and such. I thought I'd spend a moment here and talk about what they are talking about when they use that term.

In the FED language, an "Exotic Hybrid Mortgage" is one where the rate is tied to a financial index, and adjusts every month. Or, should I say, a PORTION of the rate adjusts every month. I'll explain index-based mortgages in general in a future post. Specifically, these mortgages have four payment options on the payment coupon/statement every month.

First option: "minimum payment" - the cheapest option

Second option: "Interest-only payment" calculated on the note rate for that month

Third option: "30 year fully amortized payment"

Fourth option: "15 year fully amortized payment" - the most expensive option of the four

If you have one of these loans, you can choose, every month, which option to take. If you feel like it, you can choose the cheapest option, or next month you can choose another option... doesn't matter.

There are people (uneducated) who think this "Exotic Hybrid Mortgage" has only recently been created. The loan is properly called an "Option ARM" loan, and it has been around for a long time. This loan has been available to people for many years, actually. The lenders who have offered it for a long time will cite the following borrower characteristics to whom this loan was originally offered:

Property investors who didn't intend to take the loan to its fully amortized period

Home buyers who had at least 20% of the purchase price as a down payment

Home buyers who are self- or otherwise-employed in a seasonal field

Home buyers with EXCELLENT credit

If you were fitting any or all of those characteristics, you could qualify for this type of loan.

Now, before I go further, let me explain the terms of this loan more fully, so you can see its pitfalls and impacts:

Fact: All loans have two components to the payment: Principle, and Interest.

When a home owner elects to pay the "minimum payment" on their loan that month, the payment amount IS NOT EVEN COVERING ALL THE INTEREST THAT IS DUE, LET ALONE ANY PRINCIPLE. Sometimes that minimum payment is as little as $100. You are basically paying the lender to keep your loan account open. If you're astute, you will ask, "since we know interest doesn't take a day off, where does it go then?" It gets tacked on to the principle balance of your loan. We call this Negative Amortization.

When one elects to pay the "Interest-only payment", there is no principle in your payment, only interest. That one is pretty self-evident. Note though, that if one owes $200,000 as principle at the beginning of the month, and one makes an interest-only payment, you STILL owe $200,000 at the end of the month. It's like only paying the finance charges on your credit cards, never paying down the actual amount owed.

The other two payments are easy - traditional loan types there.

If you're a person who qualified for this loan, using the criteria above, you are inherently:

Good at managing your money

Financially astute

Financially solvent and stable

Living within your means

Not trying to accomplish something that is outside your means to accomplish

But here's the thing, see.

Most big lenders are public companies, and they are in the business of selling money. That's what *I* do for a living as well, I don't sell real estate, I sell money. Anyway, those public companies have numbers to hit.

And in the last run-up/frenzy in home appreciation, making "paper millionaires" out of hundreds of thousands of homeowners in California and other places, the lenders saw the opportunity/need to try and attract those borrowers into THEIR boat. Gotta make those numbers.

How to do that. Well, among other things, they made loans available to more people, by doing the following two things:

Lower the personal credit requirements to get a home

Offer to lend more of the purchase price (as in 100% of the purchase price)

These two things led to the availability of the Option Arm to almost anyone who asked for one. The recent statistics show that at least 70% of the time right now, those who have this type of loan choose the minimum payment. What does that mean? It means that 70% of the time, borrowers are going further upside down on their residence. They owe more than it's worth, because their BEGINNING loan balance was 100% of the purchase price/value. That also means that if they have/choose to sell the place, they owe more than it's worth - they would have to PAY to get out of the mortgage... that's not fun. Rather than do this (because they have no money) people are simply choosing to walk away from their mortgage, ruining their otherwise okay credit history, and jeopardizing their future ability to qualify for a mortgage of any type, ever.

So now we have a VERY LARGE GROUP of people who DON'T know how to manage themselves, but took advantage of lax credit requirements to buy more home than they should have, and now, they are swallowing the bitter pill of financial ruin.

Bernanke has offered up some "guidance" on these types of loans, and when the FED offers Guidance, it's not just advice, it's the law. He has put some things out there that lenders need to do to better qualify people for these loans.

Wednesday, September 27, 2006

Housing Bubble: Did The Media Do Enough?

By any measure, the housing market is struggling. So what should this columnist do when, say, my proprietary economic index shows local housing suffering its worst quarter since 1995?

‘Isn’t it important for the skepticism to take place?’ says investment adviser Charles Rother from Los Alamitos. ‘Housing prices in many areas of California are no longer supported by income, rents or likely employment growth. Maybe we should ask, ‘Did the media do enough?’

Paul McCulley, the top Fed watcher at Pimco bond traders in Newport Beach, summed up the media’s housing pickle best: ‘If some broker is blaming you now, he should also thank you for two years ago. Can’t have it both ways!’

Nobody complained in 2003 or 2004 about frequent reports of all-but-instant real estate wealth.

From The Palm Beach Post: "As the housing cheerleaders constantly reminded us, a plethora of fundamental factors drove the historic housing boom of the past few years. Now that the boom is over, the same cheerleaders point to a single reason prices have fallen: the media."

From The Herald Tribune: "Some Reader Advocate callers aren’t happy with the way the Herald-Tribune is covering the downturn in the real estate market in the area. One woman said that we were killing the housing market by continuing to publish stories about how bad the market is."

Another caller agreed, suggesting that we’re perpetuating the problem by reporting on the decline in median prices.

From The New York Times: "A report today showing that sales of new homes rose for the first time since March was "at first glance" a welcome respite. But economists warned that underneath the headline numbers, signs of a weakening housing market were more prevalent than ever."

Sales figures for July were revised to show that fewer homes were sold than the government first reported. As a result, the August sales data probably exaggerates the resiliency of the market. Economist Stuart Hoffman called the August increase a ‘dead cat bounce.’

The August numbers could also be inflated. Because new home sales are recorded when the contract is signed, not when the deal is closed, the data do not factor in cancellations. Yet builders have said recently that cancellation rates are running as high as 30 percent, suggesting that the Commerce Department's numbers make the housing market appear healthier than it actually is.

"It certainly is possible that for a variety of reasons you could have a one-month upturn, but I doubt that will reverse the trend that seems to be occurring," said Kenneth Simonson, chief economist for the Associated General Contractors of America.

Mr. Simonson noted the possibility that the August sales numbers could be revised downward, just like the July numbers were. "I think we could still wind up seeing that this month is a continuation of the downturn."

Monday, September 25, 2006

Clearing Up Closing Costs

I will say this about making inquiries to online lending institutions, suck as [sic] E-Loan, Bankrate.com, Quicken Loans, etc.: BEWARE, before you know it, you will have 25 credit inquiries showing on your credit file, and your score will DROP, pronto. Also, be aware that lenders who also own settlement companies (title companies), and insurance providers put you at a disadvantage. Think about it. Why would a lender go to the trouble and regulation of also owning settlement companies, and insurance providers? One of my favorite phrases: follow the money. In this case, yours, out the door. You should feel like a dog stuck in a corner in that situation. If you don't, well, you'll get taken, every which way from Sunday. With that said, here are the results of the online survey of online lenders:

When you compare mortgage offers, you have to know which fees to pay attention to and which costs to ignore until later.

It's worth taking the time to contrast loan offers. A Bankrate.com survey of online mortgage lenders found that estimated fees vary widely. Some lenders are more thorough than others when they estimate the fees and taxes involved in a transaction, making it confusing to comparison-shop.

There are five kinds of closing costs:

- Fees that the broker or lender charges

- Fees that third parties control

- Taxes

- Title insurance

- Prepaid items

When you compare brokers and lenders, the first two types of costs are the ones to pay attention to. Fortunately, those are the costs that lenders are most likely to estimate correctly. On the other items -- taxes, title insurance and prepaid items -- the online lenders in Bankrate's survey are inconsistent, often incomplete and frequently inaccurate.

You can't blame the lenders, really. Estimating closing costs nationwide, based on information that customers provide online, is like driving a 1979 AMC Pacer across the country: Breakdowns are inevitable. This is especially true with taxes, which vary by location, and title insurance, where local custom governs who pays for what.

Borrowers first should scrutinize each lender's cost estimate and add up all the fees that the lender directly controls, plus third-party fees associated with getting the loan. Lenders are aware that this isn't easy. Even if you get multiple quotes and compare them, "it's still very difficult to go through and say, 'What am I really paying? What do I have to pay and what do I not have to pay?'" says Rob Snow, vice president of retail lending for E-Trade.

Understanding good faith estimates

When you apply for a mortgage, the lender is required to give you a standard form called the good faith estimate of closing costs, the operative word being "estimate." What an online lender presents to you isn't officially a good faith estimate, and the information presented there is what Bankrate compiled in the fee survey.

"What you see on the screen is in a sense a summary of the costs, but not in the detailed format of a good faith estimate," Snow says. "I hope it wouldn't change at all in terms of the bottom-line number." However, sometimes it is very difficult for these costs to be exactly what you will see at the closing table, sometimes changing up to 1% (of the purchase price or loan amount) total in costs.

This is not a problem with the lender, rather it is a error in the entire industry. Programs change, individual situations can alter the initial good faith estimate fees.

It's a similar story at rival Amerisave, where Dave Herpers, director of consumer affairs, says the technology that the lender deploys to display detailed closing costs online is identical to that used to prepare good faith estimates. "Assuming that nothing changes from what you searched on the Web site to your application, the fees would be identical," Herpers says.

The good faith estimate is divided into sections of similar fees, each denoted by a range of numbers: the 800s, 900s, 1000s, 1100s, 1200s and 1300s. For comparison-shopping, the most important fees are the ones listed in the 800s. Most of these items are controlled by the lender or broker, so the estimates should be accurate. A few of the items in the 800 series are charged by third parties, and the lender shouldn't be far off in those estimates.

The lender or broker has direct control over origination and discount points and fees (801 and 802) and administrative, processing, funding, document prep, wire transfer and other fees (810 and higher).

Third-party fees in the 800s include the appraisal, credit report, underwriting, inspection, mortgage insurance application, assumption, tax service and flood certification. These fees are supposed to be passed along to you without markup.

Some national mortgage lenders own subsidiaries that perform these functions, so they have a good handle on what the costs will be. Be careful with situations like this, as it is easy for related companies to take advantage of borrowers who are ill-informed. You should expect smaller lenders and brokers to estimate these fees fairly accurately, even though they don't own subsidiaries that offer the services.

Fees in the 1300 series -- for surveys and pest inspections -- should be easy for lenders to estimate accurately, too.

The 900s and 1000s cover prepaid items -- mortgage, hazard and flood insurance premiums, mortgage interest and taxes that must be paid up front or deposited in an escrow account.

The 1100s comprise title charges: title insurance premiums, settlement or escrow fees, attorney costs and notary fees. These fees are the most difficult to estimate and lenders can only guess as to the final fees here. This is not the fault of the lender rather than how the industry as a whole is put together.

Items in the 1200 series consist of government charges such as city and county tax stamps and recording fees.

All the charges from the 900 series to the 1200 series are difficult to estimate. Some of the prepaid amounts vary depending on the date of closing: You would have to prepay a full month's interest if you closed on the first of the month, but not if you closed on the last day of the month. And how is the lender supposed to guess the cost of homeowners insurance?

"It's certainly a challenge, as a lender, to stay on top of all that and a challenge to explain it to borrowers as well," Snow says.

Tough costs to call

Then there are taxes and title insurance. Lenders hardly ever get them right. Take, for example, Connecticut, where Bankrate queried online lenders about borrowing $180,000 to buy a theoretical $225,000 house in the 06103 ZIP code in Hartford. According to a title agency consulted by Bankrate, the city and state taxes on such a house would total $2,250. Title insurance for owners and lenders would total $825.

None of the 15 lenders got either right.

First, the $2,250 in taxes: ABN AMRO includes taxes in its OneFee offer, which doesn't break out taxes separately. E-Trade didn't estimate taxes for Connecticut. Bank of America and Countrywide Home Loans estimated government fees of $70. Wachovia estimated $1,433. The other lenders made estimates in between.

Next, the $825 in title insurance. Estimates varied from $383.50 (IndyMac Bank) to $1,456 (Wachovia). E-Loan estimated the title insurance at $826, almost hitting the bull's-eye. Bank of America sailed wide right, too, estimating $842.85. Countrywide didn't estimate the cost of title insurance for Connecticut or any other state.

"Basically, the title insurance is a third-party fee that we can't guarantee, and typically is paid by the seller," Countrywide spokesman Rick Simon says.

It works that way in some parts of the country, but not in others. There are two kinds of title insurance policies: those that protect the lender and those that protect the buyer. Usually, but not always, the buyer ends up paying for the lender's title insurance. Customs usually vary state by state on who pays for a buyer's title policy -- and in California, it varies within the state. In Southern California (where Countrywide is based), the seller customarily pays for the buyer's title policy, and in Northern California, the buyer usually pays for his or her own policy.

These are merely customs. The buyer and seller are free to negotiate their own deal, regardless of how everyone else in town does it.

Although lenders' estimates of prepaid items, taxes and title insurance vary wildly, the actual costs come closing day won't differ much, no matter which lender you pick.

So you should ignore title insurance and taxes when you compare offers, right? "It's a reasonably fair assessment," Snow says. In most states "there's a little more variability in the title insurance than in the taxes," he says. Since the real estate agents (not the bankers) usually select the settlement agent and title insurer (which is wrong - ALWAYS insist on deciding this with the help of your mortgage broker), you have to lean on the agents to make sure you don't overpay for title insurance. (like THAT'S going to happen)

"If you're comparing lenders, I wouldn't take title and attorney fees into account at all," says Jeff Becker, director of operations for E-Loan. He recommends that you ask the attorney (or mortgage broker) or settlement agent for advice on timing the closing to hold down the cost of prepaid items.

NAR report: 9/25/06

interesting.

Bond Report: Monday, September 25

Bottom line here: there is a 33% chance now that the FED will actually have to LOWER their fed rate before the end of the year to inject stability into an inflationary and stagnant-growth economy. This will bring lower mortgage rates because investors will flock to the bond market seeking stability - prices up=yields down=lower mortgage interest rates.

My Notes here are in red:

NEW YORK (MarketWatch) -- Treasury prices rallied Monday, keeping the benchmark yield at its weakest level in almost seven months, after news that median sales prices of existing homes dropped for the first time in 11 years, providing yet another indication of the housing market's deterioration. (As I mentioned in the previous post, housing is an "economic factor" that impacts the bond market.)

The rally was not dented by some fairly harsh comments on inflation (another factor) from Dallas Fed President Richard Fisher. The 10-year Treasury note last was up 9/32 at 102-16/32 with a yield of 4.559%, its lowest level since Feb 28. Prices and yields move in opposite directions. (This says that interest rates are at their lowest points since February)

The 30-year long bond rose 17/32 to 96-25/32 with a yield of 4.702%.

The 2-year note last was up 1/32 at 100-13/32 with a 4.655% yield as the 5-year note rose 3/32 at 100-153/32, yielding 4.521%.

The Treasury market this month mostly has rallied due to expectations that a weakening economy, particularly the housing sector, will force the Federal Reserve to end its rate-tightening cycle.

The August existing-home sales report provided more grist for this argument. The National Association of Realtors group said the August decline in housing prices from year-earlier levels was only the sixth such fall in the past 30 years. The median price of an existing home fell 1.7% year-over-year to $225,000. The drop was the second largest decline in the history of the realtors' survey, exceeded only by a 2.1% drop in November 1990.

However, the number of sales exceeded analysts' expectations. Sales fell 0.5% in August to a seasonally adjusted annual rate of 6.30 million. Analysts polled by MarketWatch had projected just 6.18 million sales.

Inventories of unsold homes rose to 3.92 million, a 7.5-month supply at the August sales pace, the most since April 1993. "While the existing home sales number didn't fall as much as the survey expected, it confirms a weak trend that fixed income investors have been using to add to their long positions," said Kevin Giddis, managing director of fixed income at Morgan Keegan.

"Housing is undergoing a correction in the early third quarter that is similar to the drop-back around February, but with little pass-through -- at least thus far -- to the rest of the economy," said Action Economics. The odds of an interest rate cut by the end of the year increased after the data came out. The fed funds futures contracts last priced in a 33% chance of a rate cut by year end, up from 13% on Friday.

The Dallas Fed's Fisher, speaking at the Banco de Mexico at a conference about the conditions of the U.S. and Mexican economies, said higher inflation remains a bigger risk for the economy than a sharp slowdown of growth. (This drives people OUT of the open market and INTO the bond market, seeking better stability - prices up/yields down=rates down) "I continue to fret more about inflation than I do about growth," Fisher said. The central banker dismissed the benign August producer price report released last week as unreliable. The best gauges of inflationary pressures "are not yet comforting,"

Fisher is not a voting member of the Federal Open Market Committee. New York Fed President Timothy Geithner will speak after the market closes. He will be on a panel at Columbia University. Geithner is a voting FOMC member.

The 10 Year Bond and You: Why You Care

It's a big subject, and it has many facets, which means it's likely good for a several-part posting here. So this post is an introduction to the bond market, and some clues as to why one would post this sort of information on a real estate financing blog.

When you buy a home, or refinance a home, or open a new mortgage of any type, be it a home equity loan or whatever, that mortgage is a bond. The loose definition of a bond in this context, is an instrument created between a lender and a borrower, secured by real property. There is a rate of interest attached to it, delineating what the lender will see if/when the loan performs as it should. Boiled down, it is money lent, with the expectation of performance at a certain gain for the lender.

If you borrow money from an institutional lender, your closed mortgage goes into a large pile with other closed loans that month, or that quarter, whatever. The lender expects that (because they have made you qualify for the loan under certain terms) the loan will perform into the future, at a certain rate of return for its eventual owner.

These piles of loans (called POOLS) are then packaged up and sold to larger investors who have all the pieces in place to deal with your loan - ie: servicing - the methods used to collect your payments, make payments to your hazard insurance, tax payments, issue statements to you every month, foreclosure action, should it become necessary, etc.

The pool is purchased from the original lender, based on a likelihood of performance. The buyer of the pool will pay the originating company a percentage of the capital amount, mostly between 105% - 107%, to get the pool. Large lenders compete for these pools, and the amount they pay for them makes up a pretty hefty chunk of the bond market. The factors that determine what a company like Bear-Stearns will pay for a pool are many: past performance of pools from the selling lender, economic factors - like inflation, other economic indicators, prevailing interest rates, national bond (mortgage) performance rates, etc.

The trading of these pools makes up a HUGE portion of the bond market. The relative success of buyers and sellers of these pools to agree on an equitable price for the pool has a direct impact on prevailing interest rates.

Many years ago, national interest rates were set using the US Treasury's 30 Year Bond pricing. Then a few years ago, the government stopped using the 30 year bond, and went to the 10 year bond to help determine interest rates. They felt the 10 year bond was a better indicator of economic factors in the national mind, and reflected a more realistic method for determining the FED's interest-rate policies.

So the 10 Year Bond has been the leading measure of what interest rates do for several years now. Recently the Government has begun re-issuing the 30 year bond, but interest rates are still based in the 10 Year Bond.

There are 2 parts to the bond market: Price and yield. When the Price to buy a share of a bond goes UP, it's yield goes DOWN. (When it's more expensive to buy a share of a bond on the market, sales slow, and the yield goes DOWN.) When the price goes low, yield goes up.

There are competitors to the bond market as well. These are mutual funds, other stock funds, REITS, etc. When these competitors' rates (purchase prices) go up, their volume goes down. People who would otherwise be buying these are moving to the Treasury market, looking to gain stability in their portfolios. Therefore, ALMOST all the time, when the stock market is healthy, mutual funds returning well, etc, bond PRICES are down, yields UP, because there is less demand for bonds when the open market offers better returns. When the open stock market goes down, and there is more supply than demand, the money goes to the paces where there is the most opportunity for stable return, which is the bond market. This drives pricing UP, yields down. This is not the only factor in the up/down pendulum that is stock markets/interest rates, but it's a major factor.

Here's another factor:

Over the last 36 months, the FED has raised the base-rate by .25 at every opportunity. Something like 26 straight times. That is, up until the last couple of times. It now stands at 5.25.

This is the rate that national banks use when lending money to each other overnight.

When that rate is raised, its impact on the bond market is one of giving less confidence to the bond market as it is, that we somehow need to FIX this imbalance. (lowering the PRICE, raising the yield.)

Since the fed has taken the last two opportunities to NOT raise that base rate, new breath has come into the bond market, raising prices, lowering yields. Pool buyers are now more confident in mortgages (over the last 6 months) as these bond prices have risen.

When the bond yield goes down, so do interest rates, by a directly proportional amount. Pools (bonds) are easier to sell at a profitable price, easier to make money on, and lenders are happy, they lower their interest rates a bit to attract larger pools, making more money for themselves.

So, the reason you care about the bond market is this: When the bond market prices are up, your interest rates are down. It's as easy as that.

Next post: Specific bond market analysis, showing you the daily motion of the market, with it's factors and indicators.

Thursday, September 21, 2006

I Wish I HAD To Buy A Home Here:

“The hardest-hit real-estate market segment was new homes, whose median price fell 11.6 percent to $574,000 last month, down from $649,000 a year ago. Pulte Homes is offering a week’s free vacation and up to $99,000 in incentives to buyers at its 17 Bay Area developments.”

Why offer a sales price of 574K and a 100K incentive, you ask? Because by doing it this way, it LOOKS like the price is still 574K - on paper.

It might be nice to get into that, but I hope you are planning on staying there for a long time. Refinancing will be a BITCH.

I'm just sayin.

Fed May Have to Lower Rates to Avoid Downturn

The sluggishness was also seen in a forward-looking economic gauge released early in the day, which hit its lowest level in nearly a year, sending fears of an economic slowdown through financial markets.

The yield on the benchmark 10-year Treasury note -- a proxy for how the bond market views the economy's long-term prospects -- sagged to six-month lows around 4.64 percent on the weakening data.

In the regional factory report, the Philadelphia Federal Reserve Bank said its business activity index tumbled to -0.4 in September from 18.5 in August, far below Wall Street economists' consensus forecast for a reading of 14.8. It was the first time the index had fallen below zero since April 2003. When the index turns negative, it means manufacturing is declining.

Even though the report's weakness clashed with signals from some other recent regional economic data, "generally the Philly data has the best correlation with industrial production of all the regional indices, so it needs to be treated seriously," said Alan Ruskin, chief international strategist with RBS Greenwich Capital.

The dollar dropped sharply on the report, extending its early-day losses and lifting the euro toward its biggest daily gain in about two months. U.S. stocks turned lower, with the Dow Jones industrial average down nearly 80 points.

Short-term U.S. interest rate futures shifted modestly lower after the Philadelphia Fed report to show a slight chance that the Fed might cut interest rates at its December policy-setting meeting if the economy continues to decelerate.

"We're seeing some potential moderation in inflation pressures. The (Philadelphia Fed report's) prices paid component decreased. This is good news for the Fed," said Gary Thayer, chief economist with A.G. Edwards and Sons in St. Louis, Missouri.

"It suggests that if the economy is cooling off, inflation pressures may also be subsiding," Thayer said. The trend suggests that "the Fed will probably hold rates steady for the foreseeable future and could perhaps cut interest rates early next year," he added.

Earlier, a report showed the number of U.S. workers filing new claims for jobless benefits rose slightly last week.

First-time claims for state unemployment insurance benefits rose to a seasonally adjusted 318,000 last week from an upwardly revised 311,000 in the prior week, the Labor Department said.

Separately, the New York-based

Conference Board said its index of leading economic indicators fell 0.2 percent to 137.6 in August -- the lowest since October 2005 -- after a downwardly revised 0.2 percent fall in July. It was the fourth decline in the past five months.

Another report also helped fill out a picture of a slowdown. The Chicago Federal Reserve Bank said its gauge of national economic activity fell to -0.18 in August from an upwardly revised -0.07 in July, weighed down by weaker production and employment indicators.

The Conference Board said the drop in its leading index signaled modest economic growth this fall and likely through the holiday season and into the winter.

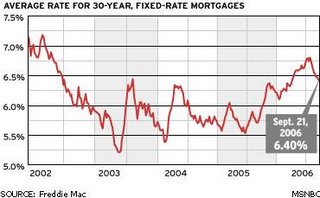

Mortgage rates at 6 month LOW

Associated Press. Updated: 11:03 a.m. MT Sept 21, 2006

WASHINGTON - Rates on 30-year mortgages fell this week to the lowest level in six months, offering support to the sagging home market.

Mortgage giant Freddie Mac said Thursday that 30-year, fixed-rate mortgages dipped to 6.40 percent this week, down from 6.43 percent last week.

The latest drop puts the 30-year mortgage at the lowest level since it stood at 6.35 percent in late March.

Rates on 30-year mortgages hit a four-year high of 6.80 percent on July 20, but since that time have been trending downward as financial markets have become more convinced that a slowing economy and recent declines in energy costs will help keep inflation contained.

Such a slowdown would allow the Federal Reserve to keep interest rates on hold. Fed officials announced on Wednesday that they were leaving a key interest rate unchanged for the second straight month, raising expectations that the Fed’s two-year campaign to raise interest rates to fight inflation pressures may be coming to an end.

Sharp declines this year in home sales and construction of new homes have provided support for the view that the economy is slowing to a more sustainable pace and eased worries about inflation.

“A slowing housing market and signs that inflation is leveling off have helped to lower mortgage rates lately and keep them affordable,” said Frank Nothaft, chief economist at Freddie Mac.

Many analysts believe interest rates will hover around current levels for the rest of the year. Such a development is expected to help the housing industry level off after sharp declines in recent months which have seen construction of new homes fall to the lowest levels in more than three years.

The Freddie Mac survey showed that other types of mortgages declined this week as well.

Rates on 15-year, fixed-rate mortgages, a popular choice for refinancing, averaged 6.06 percent, down from 6.11 percent last week.

For one-year adjustable-rate mortgages, rates dipped to 5.54 percent, down from 5.60 percent last week.

Rates on five-year adjustable-rate mortgages fell to 6.08 percent this week, down from 6.10 percent last week.

The mortgage rates do not include add-on fees known as points. Thirty-year and 15-year fixed-rate mortgages and five-year ARMs all carried a nationwide average fee of 0.5 point while one-year ARMS carried a fee of 0.8 point.

A year ago, 30-year mortgages averaged 5.80 percent, 15-year mortgages stood at 5.37 percent, one-year ARMs were at 4.48 percent and five-year ARMs averaged 5.31 percent.

Monday, September 18, 2006

Multiple loans

Things to Consider to help you qualify for multiple “Full Doc” loans; or even just one more “Full Doc” loan before having to pursue “Stated Income” loans:

30-year Mortgages: Always get a 30-Year Mortgage. 30 Year mortgages will show on paper a lower monthly debt service payment than a 25, 20 or 15 year mortgage. Most people have a coronary when they look at the “Truth in Lending” form in a loan document package. This is the form where your total financing costs are spelled out for you in black and white. Smart people, however, realize that these are the costs ONLY if you stay in that particular property or loan for its complete term. Who does THAT anymore? Just look at this as a "cost of doing business."

If you must pay off your mortgage within a certain time frame, such as 15 years, than take out a 30-year mortgage and make a 15-year payment. By doing so, your mortgage will be paid off in 15 years, yet on your credit report, you will be underwritten based on a 30-year payment, thus qualifying for more financing. The additional payment on a 15-year mortgage may result in you not qualifying for your next Full Doc loan.

If you currently have 15, 20, or 25-year mortgages, or 2nd mortgages, consider refinancing them into 30 year mortgages. You will have to gauge the expediency in this, by analyzing your break-even period with your holding period for the property in question, along with exactly how many more loans you can qualify for “Full Doc” before you have to pursue a “Stated Loan.” Remember, many times taking a small hit will pay larger dividends in the transactions to come.

Installment Loans:

Just like a mortgage, always finance your automobiles and recreational vehicles over a maximum loan (60 or 72 months) period for all of the same reasons noted above. Remember, you can always make a higher payment to pay off your loan in a shorter amount of time.

Credit Cards in relation to Mortgage loans:

Select the credit cards with the lowest monthly payment options. These recommendations will not only allow you to qualify for more financing, but they also run in concert with a very simple and very basic financial planning strategy:

“Put your dollar to work where it will work the hardest for you”

Why pay the additional $100 a month to a 15-yr 6% tax deductible mortgage when you should elect a 30-year mortgage and apply the $100 savings to your 8% non-tax deductible credit cards; or even apply the same to cash purchases you would normally charge to your 8% non-tax deductible credit card.

A note about longer amortization versus interest-only or Interest-first loans

When given the choice, the most conservative investor will be putting some money down on any purchase. The trick is to find that balance between the amount the lender requires in order to get the best rate, what your personal finances will support, and your holding strategy for the property.

Down payment money is purchased equity. It is also money tied-up. This is the balancing act. You want to put as little as possible into a deal, but you have to balance it with how much you have overall, how long it will be tied up, and the realities of whether the property will appreciate in an acceptable manner, or, if not, how much equity you have to buy to protect yourself. If you are confident in your prediction of the appreciation curve, by all means get an interest only loan (you’ll pay about 1/4 percent in rate to get it – so do the math and see if it makes sense to you.) Otherwise, always take out a 30-year mortgage, or even longer, and if possible or warranted, elect an interest only option.

In an appreciating market, why bother paying principal in a mortgage when you are paying such a low, and in many cases a tax deductible rate. On a typical 15 or 30-year mortgage, your payment is mostly interest for the first 5-yrs. Very little goes to principal. If you are an investor, your primary residence is nothing more than an investment you happen to reside in. When your home appreciates to maximum level (5-7 years) in most cases, then you will sell your home for a profit and buy another home in an area appreciating at a rate higher than the home you are currently living in. Your equity (Profit) will come in the form of appreciation and not principal reductions. It’s up to you to gauge the ability of the subject property to appreciate appropriately.