Associated Press. Updated: 11:03 a.m. MT Sept 21, 2006

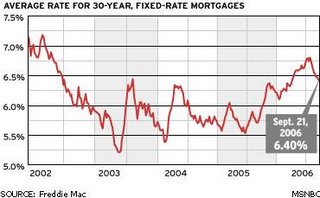

WASHINGTON - Rates on 30-year mortgages fell this week to the lowest level in six months, offering support to the sagging home market.

Mortgage giant Freddie Mac said Thursday that 30-year, fixed-rate mortgages dipped to 6.40 percent this week, down from 6.43 percent last week.

The latest drop puts the 30-year mortgage at the lowest level since it stood at 6.35 percent in late March.

Rates on 30-year mortgages hit a four-year high of 6.80 percent on July 20, but since that time have been trending downward as financial markets have become more convinced that a slowing economy and recent declines in energy costs will help keep inflation contained.

Such a slowdown would allow the Federal Reserve to keep interest rates on hold. Fed officials announced on Wednesday that they were leaving a key interest rate unchanged for the second straight month, raising expectations that the Fed’s two-year campaign to raise interest rates to fight inflation pressures may be coming to an end.

Sharp declines this year in home sales and construction of new homes have provided support for the view that the economy is slowing to a more sustainable pace and eased worries about inflation.

“A slowing housing market and signs that inflation is leveling off have helped to lower mortgage rates lately and keep them affordable,” said Frank Nothaft, chief economist at Freddie Mac.

Many analysts believe interest rates will hover around current levels for the rest of the year. Such a development is expected to help the housing industry level off after sharp declines in recent months which have seen construction of new homes fall to the lowest levels in more than three years.

The Freddie Mac survey showed that other types of mortgages declined this week as well.

Rates on 15-year, fixed-rate mortgages, a popular choice for refinancing, averaged 6.06 percent, down from 6.11 percent last week.

For one-year adjustable-rate mortgages, rates dipped to 5.54 percent, down from 5.60 percent last week.

Rates on five-year adjustable-rate mortgages fell to 6.08 percent this week, down from 6.10 percent last week.

The mortgage rates do not include add-on fees known as points. Thirty-year and 15-year fixed-rate mortgages and five-year ARMs all carried a nationwide average fee of 0.5 point while one-year ARMS carried a fee of 0.8 point.

A year ago, 30-year mortgages averaged 5.80 percent, 15-year mortgages stood at 5.37 percent, one-year ARMs were at 4.48 percent and five-year ARMs averaged 5.31 percent.

1 comment:

Informative post. Thanks for sharing such a nice article. Liked the post. keep it up.

loan modification program california

Post a Comment