Wednesday, September 27, 2006

Housing Bubble: Did The Media Do Enough?

By any measure, the housing market is struggling. So what should this columnist do when, say, my proprietary economic index shows local housing suffering its worst quarter since 1995?

‘Isn’t it important for the skepticism to take place?’ says investment adviser Charles Rother from Los Alamitos. ‘Housing prices in many areas of California are no longer supported by income, rents or likely employment growth. Maybe we should ask, ‘Did the media do enough?’

Paul McCulley, the top Fed watcher at Pimco bond traders in Newport Beach, summed up the media’s housing pickle best: ‘If some broker is blaming you now, he should also thank you for two years ago. Can’t have it both ways!’

Nobody complained in 2003 or 2004 about frequent reports of all-but-instant real estate wealth.

From The Palm Beach Post: "As the housing cheerleaders constantly reminded us, a plethora of fundamental factors drove the historic housing boom of the past few years. Now that the boom is over, the same cheerleaders point to a single reason prices have fallen: the media."

From The Herald Tribune: "Some Reader Advocate callers aren’t happy with the way the Herald-Tribune is covering the downturn in the real estate market in the area. One woman said that we were killing the housing market by continuing to publish stories about how bad the market is."

Another caller agreed, suggesting that we’re perpetuating the problem by reporting on the decline in median prices.

From The New York Times: "A report today showing that sales of new homes rose for the first time since March was "at first glance" a welcome respite. But economists warned that underneath the headline numbers, signs of a weakening housing market were more prevalent than ever."

Sales figures for July were revised to show that fewer homes were sold than the government first reported. As a result, the August sales data probably exaggerates the resiliency of the market. Economist Stuart Hoffman called the August increase a ‘dead cat bounce.’

The August numbers could also be inflated. Because new home sales are recorded when the contract is signed, not when the deal is closed, the data do not factor in cancellations. Yet builders have said recently that cancellation rates are running as high as 30 percent, suggesting that the Commerce Department's numbers make the housing market appear healthier than it actually is.

"It certainly is possible that for a variety of reasons you could have a one-month upturn, but I doubt that will reverse the trend that seems to be occurring," said Kenneth Simonson, chief economist for the Associated General Contractors of America.

Mr. Simonson noted the possibility that the August sales numbers could be revised downward, just like the July numbers were. "I think we could still wind up seeing that this month is a continuation of the downturn."

Monday, September 25, 2006

Clearing Up Closing Costs

I will say this about making inquiries to online lending institutions, suck as [sic] E-Loan, Bankrate.com, Quicken Loans, etc.: BEWARE, before you know it, you will have 25 credit inquiries showing on your credit file, and your score will DROP, pronto. Also, be aware that lenders who also own settlement companies (title companies), and insurance providers put you at a disadvantage. Think about it. Why would a lender go to the trouble and regulation of also owning settlement companies, and insurance providers? One of my favorite phrases: follow the money. In this case, yours, out the door. You should feel like a dog stuck in a corner in that situation. If you don't, well, you'll get taken, every which way from Sunday. With that said, here are the results of the online survey of online lenders:

When you compare mortgage offers, you have to know which fees to pay attention to and which costs to ignore until later.

It's worth taking the time to contrast loan offers. A Bankrate.com survey of online mortgage lenders found that estimated fees vary widely. Some lenders are more thorough than others when they estimate the fees and taxes involved in a transaction, making it confusing to comparison-shop.

There are five kinds of closing costs:

- Fees that the broker or lender charges

- Fees that third parties control

- Taxes

- Title insurance

- Prepaid items

When you compare brokers and lenders, the first two types of costs are the ones to pay attention to. Fortunately, those are the costs that lenders are most likely to estimate correctly. On the other items -- taxes, title insurance and prepaid items -- the online lenders in Bankrate's survey are inconsistent, often incomplete and frequently inaccurate.

You can't blame the lenders, really. Estimating closing costs nationwide, based on information that customers provide online, is like driving a 1979 AMC Pacer across the country: Breakdowns are inevitable. This is especially true with taxes, which vary by location, and title insurance, where local custom governs who pays for what.

Borrowers first should scrutinize each lender's cost estimate and add up all the fees that the lender directly controls, plus third-party fees associated with getting the loan. Lenders are aware that this isn't easy. Even if you get multiple quotes and compare them, "it's still very difficult to go through and say, 'What am I really paying? What do I have to pay and what do I not have to pay?'" says Rob Snow, vice president of retail lending for E-Trade.

Understanding good faith estimates

When you apply for a mortgage, the lender is required to give you a standard form called the good faith estimate of closing costs, the operative word being "estimate." What an online lender presents to you isn't officially a good faith estimate, and the information presented there is what Bankrate compiled in the fee survey.

"What you see on the screen is in a sense a summary of the costs, but not in the detailed format of a good faith estimate," Snow says. "I hope it wouldn't change at all in terms of the bottom-line number." However, sometimes it is very difficult for these costs to be exactly what you will see at the closing table, sometimes changing up to 1% (of the purchase price or loan amount) total in costs.

This is not a problem with the lender, rather it is a error in the entire industry. Programs change, individual situations can alter the initial good faith estimate fees.

It's a similar story at rival Amerisave, where Dave Herpers, director of consumer affairs, says the technology that the lender deploys to display detailed closing costs online is identical to that used to prepare good faith estimates. "Assuming that nothing changes from what you searched on the Web site to your application, the fees would be identical," Herpers says.

The good faith estimate is divided into sections of similar fees, each denoted by a range of numbers: the 800s, 900s, 1000s, 1100s, 1200s and 1300s. For comparison-shopping, the most important fees are the ones listed in the 800s. Most of these items are controlled by the lender or broker, so the estimates should be accurate. A few of the items in the 800 series are charged by third parties, and the lender shouldn't be far off in those estimates.

The lender or broker has direct control over origination and discount points and fees (801 and 802) and administrative, processing, funding, document prep, wire transfer and other fees (810 and higher).

Third-party fees in the 800s include the appraisal, credit report, underwriting, inspection, mortgage insurance application, assumption, tax service and flood certification. These fees are supposed to be passed along to you without markup.

Some national mortgage lenders own subsidiaries that perform these functions, so they have a good handle on what the costs will be. Be careful with situations like this, as it is easy for related companies to take advantage of borrowers who are ill-informed. You should expect smaller lenders and brokers to estimate these fees fairly accurately, even though they don't own subsidiaries that offer the services.

Fees in the 1300 series -- for surveys and pest inspections -- should be easy for lenders to estimate accurately, too.

The 900s and 1000s cover prepaid items -- mortgage, hazard and flood insurance premiums, mortgage interest and taxes that must be paid up front or deposited in an escrow account.

The 1100s comprise title charges: title insurance premiums, settlement or escrow fees, attorney costs and notary fees. These fees are the most difficult to estimate and lenders can only guess as to the final fees here. This is not the fault of the lender rather than how the industry as a whole is put together.

Items in the 1200 series consist of government charges such as city and county tax stamps and recording fees.

All the charges from the 900 series to the 1200 series are difficult to estimate. Some of the prepaid amounts vary depending on the date of closing: You would have to prepay a full month's interest if you closed on the first of the month, but not if you closed on the last day of the month. And how is the lender supposed to guess the cost of homeowners insurance?

"It's certainly a challenge, as a lender, to stay on top of all that and a challenge to explain it to borrowers as well," Snow says.

Tough costs to call

Then there are taxes and title insurance. Lenders hardly ever get them right. Take, for example, Connecticut, where Bankrate queried online lenders about borrowing $180,000 to buy a theoretical $225,000 house in the 06103 ZIP code in Hartford. According to a title agency consulted by Bankrate, the city and state taxes on such a house would total $2,250. Title insurance for owners and lenders would total $825.

None of the 15 lenders got either right.

First, the $2,250 in taxes: ABN AMRO includes taxes in its OneFee offer, which doesn't break out taxes separately. E-Trade didn't estimate taxes for Connecticut. Bank of America and Countrywide Home Loans estimated government fees of $70. Wachovia estimated $1,433. The other lenders made estimates in between.

Next, the $825 in title insurance. Estimates varied from $383.50 (IndyMac Bank) to $1,456 (Wachovia). E-Loan estimated the title insurance at $826, almost hitting the bull's-eye. Bank of America sailed wide right, too, estimating $842.85. Countrywide didn't estimate the cost of title insurance for Connecticut or any other state.

"Basically, the title insurance is a third-party fee that we can't guarantee, and typically is paid by the seller," Countrywide spokesman Rick Simon says.

It works that way in some parts of the country, but not in others. There are two kinds of title insurance policies: those that protect the lender and those that protect the buyer. Usually, but not always, the buyer ends up paying for the lender's title insurance. Customs usually vary state by state on who pays for a buyer's title policy -- and in California, it varies within the state. In Southern California (where Countrywide is based), the seller customarily pays for the buyer's title policy, and in Northern California, the buyer usually pays for his or her own policy.

These are merely customs. The buyer and seller are free to negotiate their own deal, regardless of how everyone else in town does it.

Although lenders' estimates of prepaid items, taxes and title insurance vary wildly, the actual costs come closing day won't differ much, no matter which lender you pick.

So you should ignore title insurance and taxes when you compare offers, right? "It's a reasonably fair assessment," Snow says. In most states "there's a little more variability in the title insurance than in the taxes," he says. Since the real estate agents (not the bankers) usually select the settlement agent and title insurer (which is wrong - ALWAYS insist on deciding this with the help of your mortgage broker), you have to lean on the agents to make sure you don't overpay for title insurance. (like THAT'S going to happen)

"If you're comparing lenders, I wouldn't take title and attorney fees into account at all," says Jeff Becker, director of operations for E-Loan. He recommends that you ask the attorney (or mortgage broker) or settlement agent for advice on timing the closing to hold down the cost of prepaid items.

NAR report: 9/25/06

interesting.

Bond Report: Monday, September 25

Bottom line here: there is a 33% chance now that the FED will actually have to LOWER their fed rate before the end of the year to inject stability into an inflationary and stagnant-growth economy. This will bring lower mortgage rates because investors will flock to the bond market seeking stability - prices up=yields down=lower mortgage interest rates.

My Notes here are in red:

NEW YORK (MarketWatch) -- Treasury prices rallied Monday, keeping the benchmark yield at its weakest level in almost seven months, after news that median sales prices of existing homes dropped for the first time in 11 years, providing yet another indication of the housing market's deterioration. (As I mentioned in the previous post, housing is an "economic factor" that impacts the bond market.)

The rally was not dented by some fairly harsh comments on inflation (another factor) from Dallas Fed President Richard Fisher. The 10-year Treasury note last was up 9/32 at 102-16/32 with a yield of 4.559%, its lowest level since Feb 28. Prices and yields move in opposite directions. (This says that interest rates are at their lowest points since February)

The 30-year long bond rose 17/32 to 96-25/32 with a yield of 4.702%.

The 2-year note last was up 1/32 at 100-13/32 with a 4.655% yield as the 5-year note rose 3/32 at 100-153/32, yielding 4.521%.

The Treasury market this month mostly has rallied due to expectations that a weakening economy, particularly the housing sector, will force the Federal Reserve to end its rate-tightening cycle.

The August existing-home sales report provided more grist for this argument. The National Association of Realtors group said the August decline in housing prices from year-earlier levels was only the sixth such fall in the past 30 years. The median price of an existing home fell 1.7% year-over-year to $225,000. The drop was the second largest decline in the history of the realtors' survey, exceeded only by a 2.1% drop in November 1990.

However, the number of sales exceeded analysts' expectations. Sales fell 0.5% in August to a seasonally adjusted annual rate of 6.30 million. Analysts polled by MarketWatch had projected just 6.18 million sales.

Inventories of unsold homes rose to 3.92 million, a 7.5-month supply at the August sales pace, the most since April 1993. "While the existing home sales number didn't fall as much as the survey expected, it confirms a weak trend that fixed income investors have been using to add to their long positions," said Kevin Giddis, managing director of fixed income at Morgan Keegan.

"Housing is undergoing a correction in the early third quarter that is similar to the drop-back around February, but with little pass-through -- at least thus far -- to the rest of the economy," said Action Economics. The odds of an interest rate cut by the end of the year increased after the data came out. The fed funds futures contracts last priced in a 33% chance of a rate cut by year end, up from 13% on Friday.

The Dallas Fed's Fisher, speaking at the Banco de Mexico at a conference about the conditions of the U.S. and Mexican economies, said higher inflation remains a bigger risk for the economy than a sharp slowdown of growth. (This drives people OUT of the open market and INTO the bond market, seeking better stability - prices up/yields down=rates down) "I continue to fret more about inflation than I do about growth," Fisher said. The central banker dismissed the benign August producer price report released last week as unreliable. The best gauges of inflationary pressures "are not yet comforting,"

Fisher is not a voting member of the Federal Open Market Committee. New York Fed President Timothy Geithner will speak after the market closes. He will be on a panel at Columbia University. Geithner is a voting FOMC member.

The 10 Year Bond and You: Why You Care

It's a big subject, and it has many facets, which means it's likely good for a several-part posting here. So this post is an introduction to the bond market, and some clues as to why one would post this sort of information on a real estate financing blog.

When you buy a home, or refinance a home, or open a new mortgage of any type, be it a home equity loan or whatever, that mortgage is a bond. The loose definition of a bond in this context, is an instrument created between a lender and a borrower, secured by real property. There is a rate of interest attached to it, delineating what the lender will see if/when the loan performs as it should. Boiled down, it is money lent, with the expectation of performance at a certain gain for the lender.

If you borrow money from an institutional lender, your closed mortgage goes into a large pile with other closed loans that month, or that quarter, whatever. The lender expects that (because they have made you qualify for the loan under certain terms) the loan will perform into the future, at a certain rate of return for its eventual owner.

These piles of loans (called POOLS) are then packaged up and sold to larger investors who have all the pieces in place to deal with your loan - ie: servicing - the methods used to collect your payments, make payments to your hazard insurance, tax payments, issue statements to you every month, foreclosure action, should it become necessary, etc.

The pool is purchased from the original lender, based on a likelihood of performance. The buyer of the pool will pay the originating company a percentage of the capital amount, mostly between 105% - 107%, to get the pool. Large lenders compete for these pools, and the amount they pay for them makes up a pretty hefty chunk of the bond market. The factors that determine what a company like Bear-Stearns will pay for a pool are many: past performance of pools from the selling lender, economic factors - like inflation, other economic indicators, prevailing interest rates, national bond (mortgage) performance rates, etc.

The trading of these pools makes up a HUGE portion of the bond market. The relative success of buyers and sellers of these pools to agree on an equitable price for the pool has a direct impact on prevailing interest rates.

Many years ago, national interest rates were set using the US Treasury's 30 Year Bond pricing. Then a few years ago, the government stopped using the 30 year bond, and went to the 10 year bond to help determine interest rates. They felt the 10 year bond was a better indicator of economic factors in the national mind, and reflected a more realistic method for determining the FED's interest-rate policies.

So the 10 Year Bond has been the leading measure of what interest rates do for several years now. Recently the Government has begun re-issuing the 30 year bond, but interest rates are still based in the 10 Year Bond.

There are 2 parts to the bond market: Price and yield. When the Price to buy a share of a bond goes UP, it's yield goes DOWN. (When it's more expensive to buy a share of a bond on the market, sales slow, and the yield goes DOWN.) When the price goes low, yield goes up.

There are competitors to the bond market as well. These are mutual funds, other stock funds, REITS, etc. When these competitors' rates (purchase prices) go up, their volume goes down. People who would otherwise be buying these are moving to the Treasury market, looking to gain stability in their portfolios. Therefore, ALMOST all the time, when the stock market is healthy, mutual funds returning well, etc, bond PRICES are down, yields UP, because there is less demand for bonds when the open market offers better returns. When the open stock market goes down, and there is more supply than demand, the money goes to the paces where there is the most opportunity for stable return, which is the bond market. This drives pricing UP, yields down. This is not the only factor in the up/down pendulum that is stock markets/interest rates, but it's a major factor.

Here's another factor:

Over the last 36 months, the FED has raised the base-rate by .25 at every opportunity. Something like 26 straight times. That is, up until the last couple of times. It now stands at 5.25.

This is the rate that national banks use when lending money to each other overnight.

When that rate is raised, its impact on the bond market is one of giving less confidence to the bond market as it is, that we somehow need to FIX this imbalance. (lowering the PRICE, raising the yield.)

Since the fed has taken the last two opportunities to NOT raise that base rate, new breath has come into the bond market, raising prices, lowering yields. Pool buyers are now more confident in mortgages (over the last 6 months) as these bond prices have risen.

When the bond yield goes down, so do interest rates, by a directly proportional amount. Pools (bonds) are easier to sell at a profitable price, easier to make money on, and lenders are happy, they lower their interest rates a bit to attract larger pools, making more money for themselves.

So, the reason you care about the bond market is this: When the bond market prices are up, your interest rates are down. It's as easy as that.

Next post: Specific bond market analysis, showing you the daily motion of the market, with it's factors and indicators.

Thursday, September 21, 2006

I Wish I HAD To Buy A Home Here:

“The hardest-hit real-estate market segment was new homes, whose median price fell 11.6 percent to $574,000 last month, down from $649,000 a year ago. Pulte Homes is offering a week’s free vacation and up to $99,000 in incentives to buyers at its 17 Bay Area developments.”

Why offer a sales price of 574K and a 100K incentive, you ask? Because by doing it this way, it LOOKS like the price is still 574K - on paper.

It might be nice to get into that, but I hope you are planning on staying there for a long time. Refinancing will be a BITCH.

I'm just sayin.

Fed May Have to Lower Rates to Avoid Downturn

The sluggishness was also seen in a forward-looking economic gauge released early in the day, which hit its lowest level in nearly a year, sending fears of an economic slowdown through financial markets.

The yield on the benchmark 10-year Treasury note -- a proxy for how the bond market views the economy's long-term prospects -- sagged to six-month lows around 4.64 percent on the weakening data.

In the regional factory report, the Philadelphia Federal Reserve Bank said its business activity index tumbled to -0.4 in September from 18.5 in August, far below Wall Street economists' consensus forecast for a reading of 14.8. It was the first time the index had fallen below zero since April 2003. When the index turns negative, it means manufacturing is declining.

Even though the report's weakness clashed with signals from some other recent regional economic data, "generally the Philly data has the best correlation with industrial production of all the regional indices, so it needs to be treated seriously," said Alan Ruskin, chief international strategist with RBS Greenwich Capital.

The dollar dropped sharply on the report, extending its early-day losses and lifting the euro toward its biggest daily gain in about two months. U.S. stocks turned lower, with the Dow Jones industrial average down nearly 80 points.

Short-term U.S. interest rate futures shifted modestly lower after the Philadelphia Fed report to show a slight chance that the Fed might cut interest rates at its December policy-setting meeting if the economy continues to decelerate.

"We're seeing some potential moderation in inflation pressures. The (Philadelphia Fed report's) prices paid component decreased. This is good news for the Fed," said Gary Thayer, chief economist with A.G. Edwards and Sons in St. Louis, Missouri.

"It suggests that if the economy is cooling off, inflation pressures may also be subsiding," Thayer said. The trend suggests that "the Fed will probably hold rates steady for the foreseeable future and could perhaps cut interest rates early next year," he added.

Earlier, a report showed the number of U.S. workers filing new claims for jobless benefits rose slightly last week.

First-time claims for state unemployment insurance benefits rose to a seasonally adjusted 318,000 last week from an upwardly revised 311,000 in the prior week, the Labor Department said.

Separately, the New York-based

Conference Board said its index of leading economic indicators fell 0.2 percent to 137.6 in August -- the lowest since October 2005 -- after a downwardly revised 0.2 percent fall in July. It was the fourth decline in the past five months.

Another report also helped fill out a picture of a slowdown. The Chicago Federal Reserve Bank said its gauge of national economic activity fell to -0.18 in August from an upwardly revised -0.07 in July, weighed down by weaker production and employment indicators.

The Conference Board said the drop in its leading index signaled modest economic growth this fall and likely through the holiday season and into the winter.

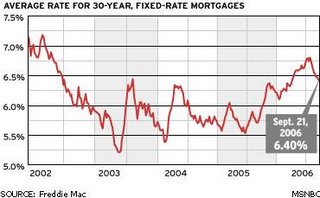

Mortgage rates at 6 month LOW

Associated Press. Updated: 11:03 a.m. MT Sept 21, 2006

WASHINGTON - Rates on 30-year mortgages fell this week to the lowest level in six months, offering support to the sagging home market.

Mortgage giant Freddie Mac said Thursday that 30-year, fixed-rate mortgages dipped to 6.40 percent this week, down from 6.43 percent last week.

The latest drop puts the 30-year mortgage at the lowest level since it stood at 6.35 percent in late March.

Rates on 30-year mortgages hit a four-year high of 6.80 percent on July 20, but since that time have been trending downward as financial markets have become more convinced that a slowing economy and recent declines in energy costs will help keep inflation contained.

Such a slowdown would allow the Federal Reserve to keep interest rates on hold. Fed officials announced on Wednesday that they were leaving a key interest rate unchanged for the second straight month, raising expectations that the Fed’s two-year campaign to raise interest rates to fight inflation pressures may be coming to an end.

Sharp declines this year in home sales and construction of new homes have provided support for the view that the economy is slowing to a more sustainable pace and eased worries about inflation.

“A slowing housing market and signs that inflation is leveling off have helped to lower mortgage rates lately and keep them affordable,” said Frank Nothaft, chief economist at Freddie Mac.

Many analysts believe interest rates will hover around current levels for the rest of the year. Such a development is expected to help the housing industry level off after sharp declines in recent months which have seen construction of new homes fall to the lowest levels in more than three years.

The Freddie Mac survey showed that other types of mortgages declined this week as well.

Rates on 15-year, fixed-rate mortgages, a popular choice for refinancing, averaged 6.06 percent, down from 6.11 percent last week.

For one-year adjustable-rate mortgages, rates dipped to 5.54 percent, down from 5.60 percent last week.

Rates on five-year adjustable-rate mortgages fell to 6.08 percent this week, down from 6.10 percent last week.

The mortgage rates do not include add-on fees known as points. Thirty-year and 15-year fixed-rate mortgages and five-year ARMs all carried a nationwide average fee of 0.5 point while one-year ARMS carried a fee of 0.8 point.

A year ago, 30-year mortgages averaged 5.80 percent, 15-year mortgages stood at 5.37 percent, one-year ARMs were at 4.48 percent and five-year ARMs averaged 5.31 percent.

Monday, September 18, 2006

Multiple loans

Things to Consider to help you qualify for multiple “Full Doc” loans; or even just one more “Full Doc” loan before having to pursue “Stated Income” loans:

30-year Mortgages: Always get a 30-Year Mortgage. 30 Year mortgages will show on paper a lower monthly debt service payment than a 25, 20 or 15 year mortgage. Most people have a coronary when they look at the “Truth in Lending” form in a loan document package. This is the form where your total financing costs are spelled out for you in black and white. Smart people, however, realize that these are the costs ONLY if you stay in that particular property or loan for its complete term. Who does THAT anymore? Just look at this as a "cost of doing business."

If you must pay off your mortgage within a certain time frame, such as 15 years, than take out a 30-year mortgage and make a 15-year payment. By doing so, your mortgage will be paid off in 15 years, yet on your credit report, you will be underwritten based on a 30-year payment, thus qualifying for more financing. The additional payment on a 15-year mortgage may result in you not qualifying for your next Full Doc loan.

If you currently have 15, 20, or 25-year mortgages, or 2nd mortgages, consider refinancing them into 30 year mortgages. You will have to gauge the expediency in this, by analyzing your break-even period with your holding period for the property in question, along with exactly how many more loans you can qualify for “Full Doc” before you have to pursue a “Stated Loan.” Remember, many times taking a small hit will pay larger dividends in the transactions to come.

Installment Loans:

Just like a mortgage, always finance your automobiles and recreational vehicles over a maximum loan (60 or 72 months) period for all of the same reasons noted above. Remember, you can always make a higher payment to pay off your loan in a shorter amount of time.

Credit Cards in relation to Mortgage loans:

Select the credit cards with the lowest monthly payment options. These recommendations will not only allow you to qualify for more financing, but they also run in concert with a very simple and very basic financial planning strategy:

“Put your dollar to work where it will work the hardest for you”

Why pay the additional $100 a month to a 15-yr 6% tax deductible mortgage when you should elect a 30-year mortgage and apply the $100 savings to your 8% non-tax deductible credit cards; or even apply the same to cash purchases you would normally charge to your 8% non-tax deductible credit card.

A note about longer amortization versus interest-only or Interest-first loans

When given the choice, the most conservative investor will be putting some money down on any purchase. The trick is to find that balance between the amount the lender requires in order to get the best rate, what your personal finances will support, and your holding strategy for the property.

Down payment money is purchased equity. It is also money tied-up. This is the balancing act. You want to put as little as possible into a deal, but you have to balance it with how much you have overall, how long it will be tied up, and the realities of whether the property will appreciate in an acceptable manner, or, if not, how much equity you have to buy to protect yourself. If you are confident in your prediction of the appreciation curve, by all means get an interest only loan (you’ll pay about 1/4 percent in rate to get it – so do the math and see if it makes sense to you.) Otherwise, always take out a 30-year mortgage, or even longer, and if possible or warranted, elect an interest only option.

In an appreciating market, why bother paying principal in a mortgage when you are paying such a low, and in many cases a tax deductible rate. On a typical 15 or 30-year mortgage, your payment is mostly interest for the first 5-yrs. Very little goes to principal. If you are an investor, your primary residence is nothing more than an investment you happen to reside in. When your home appreciates to maximum level (5-7 years) in most cases, then you will sell your home for a profit and buy another home in an area appreciating at a rate higher than the home you are currently living in. Your equity (Profit) will come in the form of appreciation and not principal reductions. It’s up to you to gauge the ability of the subject property to appreciate appropriately.

Many lenders are finding it easy to sell mortgage terms that are LONGER than 30 years, and indeed, FNMA (Fannie Mae) has recently introduced a 50 year term. They view this as a better risk for you than interest-only. Consider it, if your heart can take the Truth In Lending form…

Mortgages for any less than 30 years are “Old School”. When you are building your wealth, leverage your dollar to the fullest extent. Once you become wealthy, focus on net holdings. By then you’ll have the ability to pay cash for that 100-unit apartment building or office complex that will generate $100,000 a year in net rental income. Until then, put your dollar to work for you.

We invest countless hours in educating and assisting our R.E. Investor Clients in developing a strong Credit Profile. This is part of our investment into our Clients. This insures top tier loan programs and multiple transactions for our clients, which results in additional transactions for our office. With our low pricing schedules, we do not become profitable until you are funding multiple transactions. You will not qualify for multiple transactions unless you are willing to commit to improving your overall credit and debt structure.

Leveraging Credit and Buying Power

A solid and dependable financing source with diverse financing programs will be the main contributing factor in your success as a Real Estate Investor. Part of this success will be a direct result of your knowledge and ability to effectively manage your credit, and credit scores. You need to understand how your credit report will impact your ability to qualify for top tier financing, and in some cases simply qualify for any financing at all. You must not just “Know How to”, but you must be committed to following simple & basic guidelines to help build, preserve and/or hedge against, your ability to continue meeting lending guidelines.

Face reality.

Way too many of my clients feel they have great credit, when in fact, their credit is marginal to good at best. In today's mainstream sectors, “Credit Scores” will set the pace in credit risk evaluation. The lending industry will judge you based on the middle of all three scores:

750 – 800 Excellent Credit

720 – 749 Excellent Credit, however, you will need to take precautionary measures

680 – 719 Good Credit

650 – 679 Fair Credit

600 – 649 Marginal / Poor Credit

550 – 599 Bad Credit

525 – 549 Really Bad Credit

500 – 524 Feel lucky to get a loan

Below 500 You are wasting your time. Consider acting responsibly by managing your debt and savings before thinking you should buy a house.

Where to go to find out what your scores are

Don't get suckered into thinking that your REAL score is the one you saw on that free report web site. A mortgage score is different, and you will be disappointed. If you are considering a mortgage, spend the $15 and get a credit report from a mortgage lender, like me.

Here are some things you can do to build your credit, preserve your credit, and hedge against reductions in scores as you inherit new debt (Close on new transactions):

Credit Cards:

Only keep 2-4 revolving Credit Cards Open. Your total amount of revolving debt should not exceed 40% of the total amount of credit reported on your credit report. In other words, if you have nine total lines of credit, you should not have more than 3 or 4 open credit cards.

Close all department store, retail store and gas cards that are not “the big four” – Visa, MC, AmEx, Discover. These cards are completely useless.

Only keep “Major” cards open, such as MC, Visa, Discover and AMEX (Revolving).

If you have multiple “Major” cards than you should have open, close the newest cards and keep the oldest ones open.

Increase the available limit on your oldest “Major Cards”, which you decide to keep open (5 – 20k). This leverages your debt-to-credit ratio.

Prove to the creditors and credit agencies that you are not afraid to use your credit. Do not however, maintain a balance in excess of 30 – 40% of your available credit. DO NOT payoff your credit cards.

DO NOT play the game of opening new accounts because of low introductory rates, balance transfer incentives, or even for that matter, lower rates. Opening a new credit card will have a negative and in some cases a significantly negative impact to your credit score no matter what.

Note: Sometimes one must make a lateral move, or even pay a little more interest in order to move forward at a much faster pace. Closing a new credit card account with a 7% rate and keeping an old account open with a 10% rate may not seem prudent. However, if this means the difference between a 717 and a 724 score, then that will mean the difference between a 6.5% and a 7.125% rate on a $100,000 or several $100,000 mortgages. So tell me…does paying an additional couple hundred dollars of credit card interest per year justify saving several thousands of dollars in mortgage interest resulting in you qualifying for top tier pricing? You bet it does! DO NOT MICRO MANAGE your finances in the wrong areas.

Negative credit report items

Negotiate payoffs for any outstanding collections, liens and/or judgments you may have. Even if you dispute such, keeping them on your bureau as an "Outstanding" debt, will effect your credit score.

Stop allowing people to pull your credit. Multiple credit inquiries are detrimental to credit scores. Any lender will also require a written explanation for each inquiry, including information about whether a new line of credit was established as a result of the inquiry. This becomes difficult to manage. You need to have a “clean credit appearance” in order for lenders to give you best-rate pricing. Any duplicated or erroneous items on your credit report should be removed by writing a letter of dispute to all three major credit bureaus. Don't believe the myth that negative credit will fall off your credit report after seven years. It only applies to accounts that have been satisfied. Open Collections, judgments and liens will remain on your credit report indefinitely. The 7-year clock begins to tick only after the account has been satisfied.

Hedging Your Debt to Income Ratio:

One of the most common mistakes home-buyers make is their failure to plan ahead. Planning ahead with your financing is more important than finding a good deal on a home. A good deal on a home may result in an extra few thousand dollars in profit. Failing to plan ahead with your financing can mean tens of thousands of dollars in unnecessary costs!

Contrary to what most believe, you should always proceed forward with “Full Documentation” loans until you reach a point where you simply cannot qualify for any additional financing. At that point, it is time to proceed forward with a “Stated Income Loan Program.”

Why is this so? Full Doc loans equate to better rates, more lenient credit & reserve requirements and higher loan to values. In other words, it equates to more money. Next time you ask your accountant to employ “Creative Accounting Measures” and inflate your expenses, think about how much more you’ll be paying in the years to come. DO NOT be penny smart and dollar foolish.

Tuesday, September 12, 2006

The Truth Behind Points, Part III

ORIGINATION POINTS

We have already discussed Origination points extensively in the previous two posts on this topic.

Discount Points, like Origination Points, run in increments of .125’s (1/8's).

But unlike Origination points, Discount Points are used to "Buy the Rate".

We discussed previously how rate is tied to broker pricing/income. Discount Points are used to buy the rate of a loan to a place that is BELOW the buy-rate a broker or lender offers. With Discount Points, you can obtain a rate that otherwise represents a COST to the broker, as opposed to a rebate (income) to the broker.

In a nut shell:

Since we know that Secondary Marketing sets pricing for the Correspondents, Lenders and Brokers, we know that Secondary sets rates, together with the rebate associated with a particular rate, every day. Most lenders show pricing that is both above (rebate, or income) and below (cost to broker) on their rate sheets every day. So, extrapolating the rate grid we used earlier, the full rate sheet might look something like this:

4.875% - 98.5 (cost to broker of 1.5%)

5.0% - 99 (cost to broker of 1%)

5.125% - 99.5 (cost to broker of .5%)

5.250% - PAR (neither a cost nor a rebate)

5.375% - 100.500 Rebate

5.500% - 101.000 Rebate

5.625% - 101.500 Rebate

5.750% - 102.000 Rebate

5.875% - 102.500 Rebate

6.000% - 102.875 Rebate

6.125% - 103.250 Rebate

If you think about this for a moment, you'll notice that you CAN buy a rate that is lower than the broker's buy rate. But you'll also notice that will COST you .5% . So if we think of that ficticious $100,000 loan again for a moment, you'll notice that it will COST .5%, or $500 to buy your rate down by .125% (an eighth), to a rate that is below what the broker can make money on. It's up to you, the borrower, to determine if this investment is wise for you; it'll cost you $500 on the front of the transaction to have the opportunity to save .125 in note rate.

The numbers: the P+I on $100,000 at 5.25% is 552.20. The P+I on $100,000 at 5.125% is 544.49. You save $7.71 per monthly payment. It will cost you $500 to get that monthly savings. It will take you 64.85 months to see a financial benefit from doing this. If you won't be in that home that long, or in that mortgage that long, you're wasting your money.

As you are no doubt aware, the spreads, rates, and buydown ratios change all the time. A good mortgage broker should be willing to sit down with you and help you determine the best strategy for dealing with discount points as they relate to your payment, and to your long-term strategies.

Note also that as you think about Discount Points, you should realize (and it may or may not be obvious) that when your rate is a COST to the broker, you will have to pay that cost, in closing costs. In addition, the broker office will still be expecting to make its customary 3% in origination. On the settlement statements, you'll see two line items:

line 801: Loan Origination Fee: ____________ (this will be a dollar figure, representing the broker office income)

line 802: Loan Discount: _____________ (this will be the dollar figure that is charged to you as a closing cost, buying the rate down)

A broker will never be allowed (by RESPA - the Real Estate Settlement Procedures Act) to collect lender-paid compensation, or REBATE, when there is also a discount fee to BUY rate. Therefore, the entire office income will be derived from line 801 on the settlement statement.

Also, Discount Points on line 802 of the settlement statement are the only items in this real estate transaction that are TAX DEDUCTIBLE for you. So that's another benefit to weigh out when you are thinking about your long term strategy.

Saturday, September 09, 2006

The Truth Behind Points, Part II

The Relationship between Borrowers and Brokerage revenue

Mortgage Lender Branch or Mortgage Broker Revenue

Just because a bank, mortgage lender or mortgage broker branch brings in $3,000 in revenue, does not mean the Loan Officer earns $3,000 in commission. In general, 50% will go to the branch or broker to meet overhead, leaving your Loan Officer to earn a modest $1,500.

Banks and Mortgage Lenders generally have minimum Branch Requirements per loan. $2,000 - $3,000 is average for conventional loans. Mortgage Brokers & Correspondents can extend more flexibility and may, should they choose to, only generate $1,500 or even $1,000 gross revenue on a loan, for a really good client, friends, family, etc.

Some newbie Loan Officers may also work for $1,000 or $1,500 ($500 to $750 in commissions) because they need the business. I will say this: you will always get what you pay for.

Real Estate Investor-specific information

Don't nickel and dime a good Loan Officer as he or she will make you or save you tens of thousands of dollars over the course of a relationship. Let him or her make what they generally make and the service will come ten fold.

HELOCS: Don't think you are doing your loan officer any favors by originating a $30,000 HELOC (Home Equity Line of Credit) for you. Home Equity Line of Credit Loans are issued to our Real Estate Investor Clients as an added service.

In order for a branch to meet their $3,000 requirement, the Loan Officer will have to charge you about 6.5 points to do your loan, as most HELOCS do not provide for yield spread premiums (Commissions from secondary or wholesale).

In my opinion, that's a rip off for a $30,000 HELOC. So what ends up happening is your Loan Officer does all of that work and charges a modest 1-2 points in order to remain competitive. In other words, his branch will gross $300 - $600 for doing your HELOC loan, and he will earn approximately $150 - $300 in commissions, if that.

As you can see by the above examples, there is very little money to be made in HELOCs. The originating industry funds HELOCs for clients as an added service, with the hopes that they are given the opportunity to fund the next $100,000 or $500,000 purchase or refinance loan for their HELOC clients.

Shopping For the Best Deal

Next time you are shopping for a mortgage, don't ask the questions everybody in the industry dreads:

- What is your rate?

- How Many Points are you charging?

- Can you fax me a Good Faith Estimate?

Those are signs of a Green Horn or Newbie Real Estate Investor who bought the wrong "How to get rich by investing in Real Estate" book.

Find someone you feel totally comfortable with. Someone who knows the game and can help you structure your deals as if they've done it a thousand times. Someone who has worked with numerous Real Estate Investors, and can provide you insight in credit, income & asset structuring. Someone who can analyze your Real Estate Investment objectives and structure your transaction with your tenth transaction in mind (Very IMPORTANT). Someone who can guide you in making sound investment decisions. Someone who is honest enough to tell you what they need to make per loan and honest enough to tell you that the property you are looking at stinks and not to buy it. Find someone who will work with your interests in mind. Someone looking to establish and grow a strong Lender - Borrower Relationship with you!

That someone must have access to unlimited mortgage lenders, so they can obtain the most competitive wholesale pricing.

Banks and pure mortgage lenders are out of the question. Find any Bank or Lender and most "Multi-capacity Lenders/Brokers" will beat their conventional quote by at least .250% every single time. Don't make the mistake of thinking that you should go straight to the bank for lending, falsly thinking you are "big-time" enough to go right to the source. WRONG.

Larger Multi-capacity Correspondent Lenders and Brokerage Houses who have been in the business for long periods of time with track records of funding large volume through their wholesalers will generally receive additional production bonuses. Also, if you are dealing with an honest Loan Officer who is in this position, they will pass those savings on to you.

Find yourself a good Mortgage Broker who is knowledgeable, and has lots of loan volume. That optimizes your ability to procure the best possible pricing and have access to an unlimited pool of lending products and lenders, just in case you or the people buying your homes and/or cashing out your Lease Options may not qualify for Conventional/FNMA Loan Programs.

With that said, the questions you should ask are:

a. How many residential loans have you personally closed in the last 12 months, and how many were investment properties?

b. Can you spend some time with me and let's discuss what you know about Real Estate Investing and how you can help my business grow?

c. Based on how many and the type of homes I wish to purchase per year and my credit & income profile, how much are you willing to work for per loan?

If you want to be a successful Real Estate Investor, you will need a dependable source of money. A source you can call, provide particulars to, and trust them to get the deal done, so you can spend your time looking for the next good buy and not worrying about your loan funding.

Thursday, September 07, 2006

The Truth Behind Points, Part One

ORIGINATION POINTS

Points run in increments of .125’s (1/8's).

On a $100,000 loan, .125 of a point is $125 and 1 point is $1,000. Points are not always a bad thing. In fact, points can be very good. It is not as complicated as one would think. You first need to understand the relationship between originatin points and your proposed lender or broker, then understand the relationship between origination points and the holding period of your investment (How long do you intend to keep the home as a residence or for investment purposes).

Background Info:

Secondary Marketing sets pricing for the Correspondents, Lenders and Brokers. Secondary is where all mortgage lenders sell their mortgages in bulk, in the form of fixed term securities. When a lender's loan pools are large enough (they have enough closed loans in their office), they are sold on the open, or secondary markets, as a set, or pool. Some of the larger buyers on the secondary market are FNMA, FHLMC, GMAC, as well as many insurance and investment banking firms. These securities are bought and sold on Wall Street on a daily basis, similar to how stocks are bought & sold on Wall Street.

Now let's talk about pricing on a retail level.

First and foremost, your Loan Officer who works for a bank, mortgage lender or mortgage broker, originates mortgage loans for the public on a "Retail" level. This is the only methos of procuring a mortgage.

The retail office they represent will always have a set revenue amount needed per transaction. On a standard $100,000 loan, $3,000 (or 3%, 3 points) in revenue is common for conventional type loans, $5,000 on sub prime loans, generally more on private or hard money loans, and even more on very time consuming transactions, such as commercial loans.

Let's use an example. You are dealing with a Bank, Mortgage Lender or Mortgage Broker who has a branch revenue requirement of $3,000. A par rate (Buy rate) for a 30yr conventional fixed rate mortgage (FNMA) may be 5.250% through the secondary department or wholesale department (Wholesale is who brokers and correspondents fund their mortgages through) of a Mortgage Lender or Bank. "Par rate" or "buy rate" is the lowest rate available to the broker.

The Mortgage Lender offers their retail branch and/or brokers the following pricing (Pricing changes daily in accordance with the market):

5.250% PAR

5.375% -100.500 Rebate

5.500% -101.000 Rebate

5.625% -101.500 Rebate

5.750% - 102.000% Rebate

5.875% - 102.500% Rebate

6.000% - 102.875% Rebate

6.125% - 103.250% Rebate

The "rebate" percentage is points-based. Thus, 102.500% represents 2.5%, or 2.5 points. This is an amount paid to the broker by the lender at closing.

By offering a 5.250% rate, the originating branch of the bank, mortgage lender, or mortgage broker, will not receive any compensation for doing your loan. That won't work, as there are no Charitable Mortgage Lenders, Banks or Mortgage Brokers in the industry. If you want that 5.250% rate, you will have to pay 3 points (3% of the loan amount) so the originating branch meets their $3,000 branch revenue requirement. These are "origination points."

Examples:

Your Loan Officer may offer you a rate 5.750% with no origination points. With the aforementioned pricing, they will receive 2 points ($2,000) from secondary or through the wholesale department of the mortgage lender.

Your Loan Officer may offer you a rate of 5.500%, which includes a fee of 1% in rebate points. The full $3,000 will still be met. 1% ($1,000) will come from secondary and the other 2% or $2,000 will come from you at closing in the form of origination points.

That’s how the relationship works. $3,000 may seem a bit high to the average consumer, but if you understood the amount or work involved in funding loans and the costs/risks involved in operating a mortgage lending branch or a mortgage brokerage company, $3,000 gross per transaction is on the low side.

Note: Buyers generally pay up to 6 % commissions to Realtors for simply showing a home and writing a contract. Relative to such, $3,000 in gross revenue is certainly on the low side.

Sub prime loans pay very little yield spread premium (Some don’t pay any at all), forcing originating mortgage lending branches and mortgage brokers to charge more origination points, in order to meet their revenue guidelines.

Hard Money Lenders and Private Investors do not pay any yield-spread premium. In fact, many will even charge a point or two (or more) just to fund the loan. This is why you see even more points charged by originating mortgage lending branches and mortgage brokers for these types of transactions.

Now let's talk about the relationship between your holding period and the amount of origination points you should pay. Using the above scenario:

If you borrowed a $100,000.00. A no point loan will give you a rate of 5.750%. Your payment is $583.57. If you elected to pay 2 origination points or ($2,000) to buy down the rate to 5.250%, you would then have a payment of $552.20. That's a difference of approx. $31 per month. You paid $2,000 to buy down your rate by ½ of a percent. Sound good? Maybe.

Divide $2,000 (origination points) by $31.00 and you get a breakeven period of 64.51 months.

Recommendations:

- Someone looking to buy and flip (sell immediately), paying extra origination points for a better rate is a bad choice.

- Someone looking to buy, hold and sell within 2 - 5yrs (Avg. first time home buyer), paying extra origination points for a better rate is again a bad choice.

- Someone looking to buy, hold and sell after 64.51 months should pay the origination points for a better rate, as after the 64th month, your monthly savings is pure net profit to you.

That's how origination points work. Origination points are not a bad thing, provided they are understood and applied correctly to one's Real Estate Buying Objectives.

Next item: The difference between origination points and discount points.

Experts Agree: 19 out of 10 Real Estate Agents are Morons

Listening to Radio West on KUER the other night, talking about "Your Personal Finances"....

They had a financial counselor in the studio, which was great, gave good advice... then they had a REALTOR on talking about MORTGAGES. I wanted to call in to the show and ask the moron how many loans he had closed in the last six months. He was giving all sorts of incorrect statistics, and advice.

He noted that in Utah, most of the adjustable-rate mortgages that have been commonplace in the US for about 24 months now, are 5 year fixed, and we won't see fallout of those mortgages until 2008-2010.

Ummmm... the overwhelming percentage of adjustable mortgages that have been originated in the last 24 months are 2 year adjustables, based on the LIBOR index, and the time for beginning to the see fallout from the first nasty adjustments of those mortgages is NOW.

If you want a good way to garner a foreclosure, bankruptcy, and ruined credit history, all in one swell foop, go ahead and borrow the entire amount of what some realtor thinks you should qualify for, and what some idiot mortgage office says they can get you, on a 2 year adjustable mortgage, interest-only loan. You will likely be steered toward the realtor's "preferred lender." You think they are on your team?

Go ahead. Knock yourself out. Have fun with that.

Realtors don't do mortgages, and they are not to be considered experts. They are not even to be considered "on your team." They make between 3-6% of the sales price, for doing what, exactly? Listing your home on the MLS? Looking on the MLS to FIND you a house? GIVE ME A BREAK!! On a modest $250,000 house, that's between $7500 and $15,000 into the realtor's pocket. Did you enjoy that? Somebody paid for that, and that's a lot of money. I know who that somebody was. You think they are "on your team?" Think again. Think about whether that was worth it for you.

Did you know you can list your home on the MLS by yourself for as little as $300. Period. Did you know that you can also search the MLS yourself? Did you know that there are MANY houses for sale that are NOT listed on the MLS? You don't need a realtor. You need a financial counselor that knows how to get you a mortgage that makes sense. Do you think that just because a mortgage investor says you CAN borrow a certain amount that you SHOULD borrow that amount? Are you NUTS? Pick a payment you can live with, get a mortgage commitment on a mortgage program that fits your needs, keeps you secure, and gives you long-term stability, then find a house that will provide that for you. Forget what you CAN borrow, borrow what you SHOULD borrow.

Every time you make a mortgage payment, who do you think about? The realtor that sold you the house, or the loan guy that put you in the mortgage? I'm just sayin'.

Wednesday, September 06, 2006

Different types of Real Estate Investors

What types of real estate investors are there out there?

Several.

1. Flipper. This is a guy who buys a property, never intending to live in it, most likely never intending to even make a payment on the mortgage. Sometimes he signs a purchase contract, never even intending to CLOSE on the deal. His intention is to get in and get out as fast as possible - making as much one-time profit as possible. He's not opposed to selling the CONTRACT to purchase, in a hot market.

2. Fix 'n' Flipper. This guy buys a distressed property, usually by marketing to home owners who are in distress. He's looking to buy the home, usually at less than what is owed to the mortgagee. If he makes a low offer, the owner must go to his lender and basically say, "You can accept this offer from my buyer, or you can foreclose on the property next month." Most of the time, if the offer is even SLIGHTLY realistic, the bank will accept the offer, because they are in the business of lending money, not owning crappy homes. The new buyer, or flipper, will get a rehab loan, where there is money built into the loan for the fix up, and often "selling costs" as well. If he's good at what he does, he will not likely have to make a payment on the loan before he has it fixed up and is ready to sell. Since he's also included selling costs in the loan, he's also paid for the RE Agent as well.

3. Buy Back Lease Holder. This is a guy looking for the same distressed owner as the Fix 'n' Flipper above. He will make an offer to buy the home at either exactly what is owed, or even lower, with the agreement that the current owner may stay in the home, lease it from him, and in a year or two, buy it back from the lease holder for fair market value. This gets the seller/owner out of a bad loan, allows them to stay in their home, and gives the new owner a positive cash flow for the time period the sellers are going to live in the home, and a nice chunk of profit when the new/old owner is ready to buy it back from the investor. A guy can make a comfy living on 10 of these per year, if he does it right.

4. Landlord. This guy is looking for properties, usually higher density than single family homes, like 2- or 4- plexes. But there are those who buy single family homes as rentals as well. His goals are long term stability through the tenant/landlord relationship. If he had the money, he would buy a 100-unit apartment complex. Many of them. He will diversify his holdings, leverage them on future purchases, and strive to borrow "full-doc" money (best rates/terms available), and will not buy anything that looks like it will produce a negative cash flow on a monthly basis for him. He's building his retirement holdings, one day at a time. He'll quit his day job 7 years from now. He's a VERY high net-worth individual. He's a corporate businessman.

There are other types of investors out there, variations on the theme, but these are the main categories. There are also those who dabble in more than one type of investment, seeking to be diverse. This takes time, practice, and an aversion to risk. A good investor understands the risks/benefits of each type, and plans his actions accordingly.

Too many house flippers hurt a market, every single time.

The Deseret News in Utah. “In a sign that Utah’s housing frenzy also might be at a turning point, housing prices in the St. George metropolitan area have started to soften.”

The Deseret News in Utah. “In a sign that Utah’s housing frenzy also might be at a turning point, housing prices in the St. George metropolitan area have started to soften.” “‘Absolutely, the market has turned down here,’ said Allan Carter, director of developer services for Southern Utah Title Co. ‘There are whole subdivisions filled with spec homes that in one case don’t have a single home sold.’”

“Carter blames southern Utah’s wild housing ride on real estate investors, who bought up hundreds of properties with the intention of flipping them. Last summer, roughly 40 percent of people purchasing properties in the St. George market were investors, Carter said.”

“And Carter believes the Salt Lake region is prone to what he calls a ‘train wreck’ now hitting Las Vegas and Phoenix. His advice to people looking to buy a home in the Salt Lake region is to wait until next fall. ‘You guys are going to hit the wall between April and June next year,’ Carter said. ‘It’s a huge problem.’”

“‘Florida, California and Arizona, are under stress right now, with prices coming down a little bit,’said Jeff Thredgold, an economic consultant to Zions Bank. ‘The market is prone to excess, and they got a little carried away. In our market, we lagged behind for so long..we’ve talked for some time about the fact that Utah real estate would do well for 2006, 2007 and 2008.’”

“Carter said what Thredgold and other economists are missing is the effect of the investor presence in the market. ‘It’s the same element that Vegas missed,’ Carter said. ‘He’s assuming that when a home sells it’s being bought by somebody that holds a job and will live in the home. But the people that bought the homes, bought them with the idea of putting them back on the market. So now in Vegas you’ve got 10,000 homes that have never been lived in.’”

“Clark Ivory, CEO of Ivory Homes, the state’s largest homebuilder, agrees that investors in the Salt Lake region are creating what he calls artificial demand. ‘In many cases when the investors came in the builders couldn’t supply the inventory fast enough, so the prices escalated even more rapidly, which brings in even more speculators and investors,’ Ivory said.”

“‘Builders don’t realize that many of those people that were buying their homes had no intention of occupying them. The builders are ramping up production to meet a new demand, which is an artificial demand. The whole thing is artificially inflated, and then all of a sudden there is this surge of supply,’ he said.”

Real Estate Investor: What Mortgage Term Should I Choose?

Choose a 30 yr mortgage 95% of the time. Here’s why:

Debt Load. You should structure your financing options in accordance with your long-term R.E. Portfolio Objectives. Your money source or money partner is more important than anyone or anything else in the equation. Full document lending will always generate better terms, rates and less expensive fees associated with the transactions. Therefore, Full Doc lending should always be the benchmark. If not now, you should work toward that goal in the future. Having said all of that, plan for your future transactions. In planning, choosing a 30yr mortgage will result in lower debt load. Especially over the course of several properties, which will eventually result in being able to buy one or several more properties on a full doc basis vs. a stated income basis.

Holding Period: Who holds on to a property for 30-yrs these days? Real Estate Investments should be purchased and held for a maximum period parallel to the growth cycles for a given area. Buy in appreciating markets and sell when the market begins to plateau. No need to hold on to dead properties; or properties appreciating at a rate less than state or area averages for the simple idea of owning equity. When the property begins to level off, sell immediately and replace the property with another property likely to grow at a more rapid rate. With that said, why plan to amortize properties? Equity is nothing more than your “Net” stake in a property. Equity can be converted into cash via sale or refinance. Why maintain cash in a vehicle that is no longer growing, when that cash can be used to purchase a property that is growing at a far more rapid rate?

Profit from your property through equity should be realized by appreciation and not principal reductions. If you are realizing equity by means of principal reductions and not appreciation, then you’ve purchased the wrong property!

Interest Savings: Do you really think you are saving all of that interest by paying off a mortgage in 15 years vs. 30 years? Think again. If you are borrowing money at a rate of let’s say 6%, you are probably not, if you manage your finances properly.

Example…. What if you took that $100 difference and applied it toward credit card balances that were generating rates of 8 – 10%?

What if you took that $100 difference and stuck it into a long-term mutual fund and generated an average return of 10 – 12% (And that’s conservative)

What if you took that $1,200 annual difference and used it to acquire another property using a 100% financing program ($1,200 used to pay for pre-paids associated with transaction)

What if you took that $1,200 annual difference and paid cash for items you would normally place on 8-10% credit cards.

Work the numbers, and you will see that forgone interest, like interest paid, works in conjunction with one another. Based on the above hypothetical you will save or earn a lot more than the interest you think you will save by accelerating your am period from 30-yrs to 15yrs. Not to mention, the portfolio advantages of following debt load and holding period rules.

The Unforeseen: If you are in a 15-year note, you must always make the 15-year payment. If you are in a 30-yr note, you must always make the 30-year payment (Less than the 15yr payment). What happens if you run into hard times? Lose a tenant? Lose a few tenants? It is always easier to make the 30-year payment vs. the 15-year payment. If you must/want to amortize your loan in 15 years, why not take the 30-yr note and just make a 15 year payment. This way, in the event you experience a tough month, you can always revert back to the 30-yr payment.

Put a calculator to it and you will always find your answers.

Here’s Why Not: If you don’t have the discipline to do something positive with the difference; and you do not have any intentions on buying additional investment properties; and you do not expect to ever have a difficult month (financially), then you may want to consider opting for a 15-yr mortgage.

Friday, September 01, 2006

The Top Ten Reasons your mortgage process didn't go as smoothly as you wanted it to

10. Unrealistic expectations about what the home purchaser can afford. If there is a question about whether or not you may qualify, it should be strongly suggested you take advantage of a borrowing power estimate or credit pre-approval program. If your mortgage company doesn't offer you this, you're talking to the wrong company.

9. Inadequate preparation by borrower prior to application. Real estate professionals and loan officers can work together to prepare borrowers. The more information the borrower has available at application, the more complete the loan officer's analysis can be.

8. Recognizing that borrowers may need loan programs explained. Industry jargon about an index, margin, T-bills and other terminology is familiar to real estate and mortgage professionals. But they have to remember not everyone has an in-depth understanding of the potential impact on loan terms. If your loan officer talks to you in "code", you should find someone sensitive to your knowledge-base.

7. Self-employed borrowers may not realize that they are "self employed". Consequently, you need to be aware that ownership of 25% or more in a company or commissioned income means different documentation requirements. Communicating this could mean that the issue is resolved before the loan comes to underwriting.

6. Government loans with property problems or repair conditions need to be discussed by all parties before closing. Frequently, this means that the question of who pays for the repairs must be addressed.

5. Third party vendors who do not deliver on a timely basis. Credit reports are not the issue they were in past years, but appraisals can be. "It's in the mail" excuses prevent timely turnarounds. Good mortgage professionals take pride in alligning with service providers who perform on deadlines. Bad ones use non-performance as an excuse.

4. Lack of understanding by applicants about what happens during the processing, underwriting and closing of a loan. Explanation of time frames, documentation and responsibilities of all parties is critical. Again, you should be working with someone who is willing to "teach" you everything they know about how your loan process is going to go.

3. Credit explanations which are not adequately documented and supported or which do not relate to the dates of delinquencies in the credit report. Every credit situation is different, and you should look for mortgage loan officers who have experience in dealing with credit scores, and are willing to teach you how to best manage your scores.

2. Funds to close verified and adequately tracked. Most borrowers don't understand the implications of "sourcing and seasoning" of money used in a mortgage transaction. Gift funds, for example, must have donor's ability to give the gift as well as showing the money going from donor to recipient. This must be documented via bank statements, rather than a letter from the borrower stating that "Aunt Maude is giving me a gift, and it's okay."

1. The biggest problem of all, however, is lack of communication. Many parties are involved in each transaction--buyer, seller, real estate agent, mortgage banker, appraiser, attorney and/or settlement agent. Each party must have complete understanding of what is going on at any given time. Your loan officer must take the time to explain the process to you, and make it a priority to keep you updated along every step of the way. If you get and answer that sounds like, "we should be fine," you should be looking for someone else.